CFOs now look at digitization from both sides (of the balance sheet)

- Home

- CFOs now look at digitization from both sides (of the balance sheet)

Home - CFOs now look at digitization from both sides (of the balance sheet)

Corcentric

Part One and Part Two of this blog series looked at the results of a CFO survey we collaborated on with PYMNTS.com called Digitization Strategies: How CFOs Are Prioritizing Digital Payments To Maximize Efficiency. The report, based on a survey of 250 CFOs at enterprise and mid-market businesses, examined how finance leaders strategized their digitization initiatives at the onset of the pandemic disruption, and how that experience is informing their preparations moving forward.

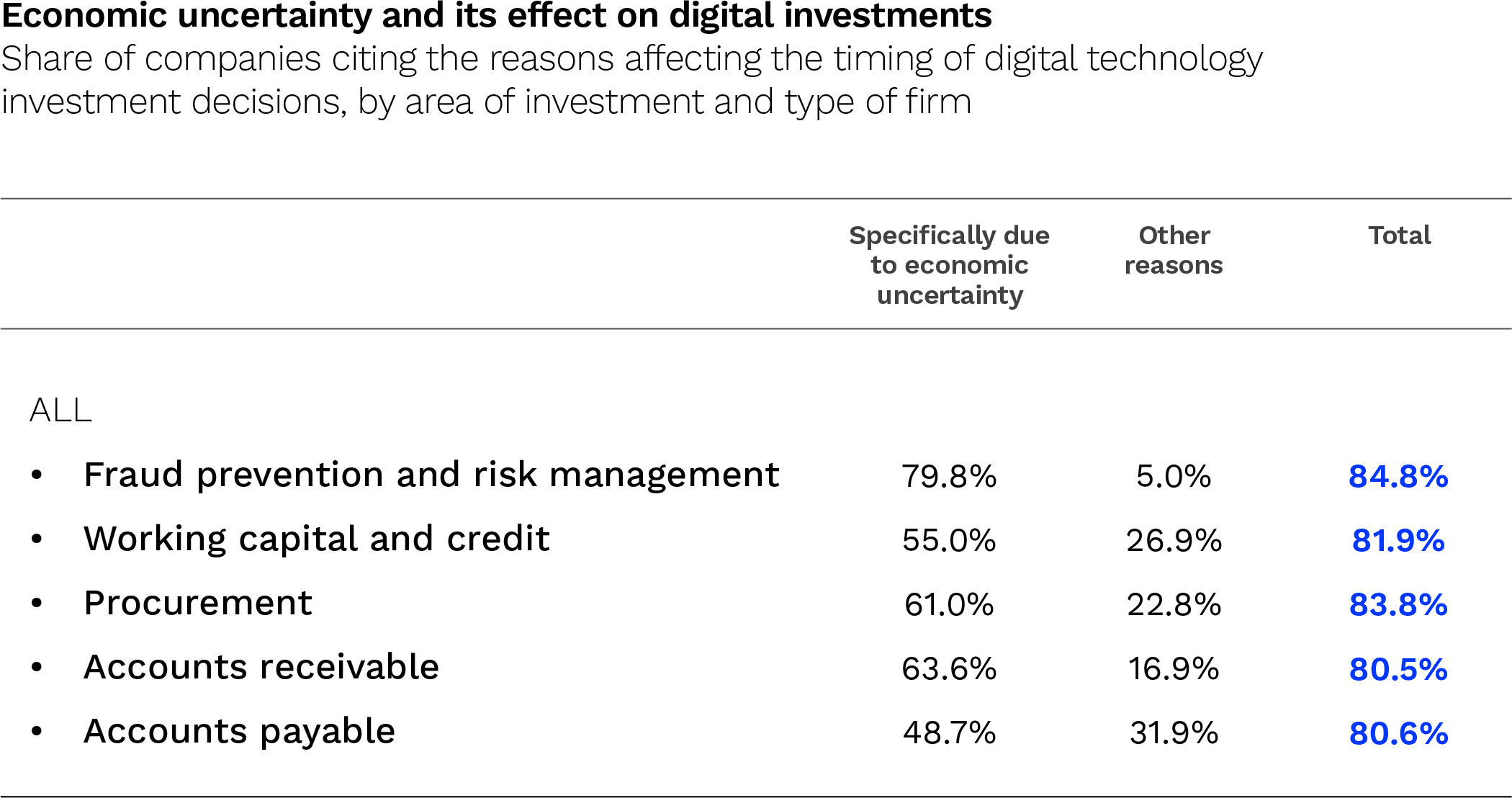

90% of CFOs surveyed said that a recession is likely in the next 12 months. How they each approach the economic challenges still to come and position their company to succeed could represent a competitive advantage.

In Part 3, we look at how and why Chief Financial Officers leveraged procurement solutions as an integral part of maintaining business operations during the pandemic, and how a growing investment in this area is part of weathering sustained disruption.

Waning economy, rising interest in procurement solutions

The role of the CFO is evolving quickly. As it relates to the survey results in our PYMNTS.com report, that role is increasingly one that includes digital transformation to drive improved business outcomes. This has been happening over the past several years, but the economic challenges brought on by the pandemic really accelerated the payments, AP, and AR digitization strategies and technology adoption by finance teams. And grabbing a bigger piece of their attention is the other side of the transaction stream, procurement.

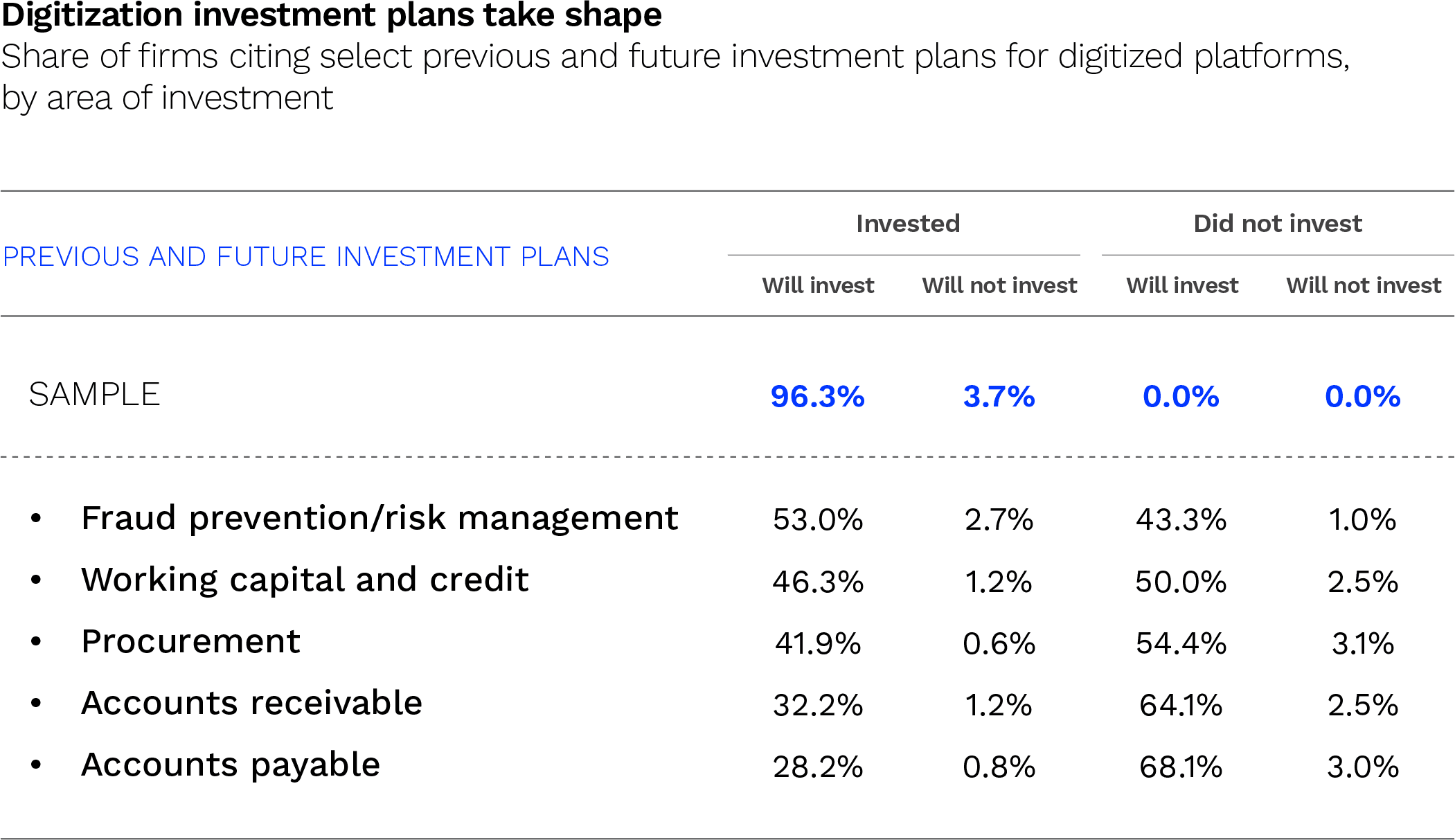

“96% of CFOs want to invest in digitized procurement platforms – this makes spend optimization a key factor in working capital management.”

That’s a pretty impressive statistic, by any measure. The respondent group was largely made up of CFOs from retail and manufacturing industries, but it most likely represents a metric that trends across companies and industries. According to the Digitization Strategies report, 42% of companies that invested in procurement (digitization) over the last two years are continuing to invest, and 54% of companies that did not previously invest in it plan to do so in the future.

While the report does not capture the specific goals and motivations driving CFOs to embrace procurement technology, their reasons are likely focused around two prime incentives: 1) controlling spend (cost containment) and 2) reinforcing supplier relationships (supply chain security). With a recession on the horizon, the quickening pace of procurement solution adoption and integration — especially by those who missed the boat during the past two years of disruption — gives credence to these two objectives.

The overwhelming interest in digitizing procurement makes perfect sense for retail and manufacturing, two areas that are particularly procurement-heavy and supplier reliant. The fragility of supply chains over the past several years — lockdowns, over demand, energy prices, geopolitical instability — made it a challenge to maintain efficient operations, putting procurement firmly in the spotlight. As the report notes, 48% of manufacturers invested in procurement processes, with 34% investing specifically in response to the pandemic.

Streamlining, automating, and simplifying the end-to-end procure-to-pay workstream, especially when focusing on data integration, pays large spend management dividends. The move to a remote workforce, when combined with a lingering talent shortage, has made procurement digitization a mandatory investment.

Manual processes in procurement are slow, cumbersome, error-prone, and expensive. Tech-savvy, innovative CFOs who are expected to be technology stewards delivering sustainable business value will be keen to replace them with maximum efficiency and automation. In the process, they can also gain the real-time spend visibility that will make them much better informed about how much to spend, where to spend it, and when is the optimum time to spend it. As part of a holistic working capital management effort, digital procurement becomes a strategic CFO’s spend management portal.

Managing procurement spend to navigate economic challenges

As mentioned, the CFO role has evolved, taking on much more responsibility beyond the finance function in the process. According to McKinsey, the areas that report into the CFO went from 4.5 in 2016 to 6.2 in 20181, and that trend is still growing. Having increased influence at the c-suite level organization wide, puts CFOs in an ideal position to partner with procurement to expand the breadth and level of authority they wield in controlling spend.

By bringing more areas under control, including HR, IT, facilities, professional services, etc., the CFO can help to deliver bigger cost savings. The more spend under management the organization can achieve, the greater the impact on the balance sheet, working capital, cash flow, and even profitability. It’s also an important factor in risk management, by helping mitigate or eliminate dark spend and fraud.

During a recession or similar economic constriction, capital efficiency can create opportunities, competitive advantages, and even act as an operational lifeline. According to CFO.com, “CFOs who work alongside their procurement officers can dramatically improve their EBITDA through procurement-related optimization and mitigate risk through supplier resiliency.”2

To achieve this requires procurement digitization and data integration. Data-driven CFOs know this, and their growing interest in and focus on procurement digitization and new technologies is manifesting itself accordingly.

Or not… As an epilogue to this digitization story, it’s worth noting that “38% of procurement process technologies that were implemented to maintain business operations during the pandemic have been discontinued,” according to the PYMNTS.com survey. Again, these types of decisions and actions aren’t explained in the analysis, so perhaps they can be chalked up to what we mentioned in Part Two of this series, a lack of ROI (or budgeting) on those procurement technologies.

It’s difficult to say for sure, without knowing what type of digital procurement solutions were implemented, what stakeholder expectations and engagement was, whether IT was involved in the right way, if a change management and user adoption strategy were included, etc., etc. What it shouldn’t signal is that procurement digitization is hit-or-miss, or of secondary consideration.

As we mentioned, procurement digitization is essential, especially at mid-market and enterprise level companies. There is no other way to achieve the spend data visibility and control to empower better decision making than with digital procurement technology. Having said that, CFOs and procurement leaders might be better suited to procurement managed services or Group Purchasing Organizations (GPOs), at least for some categories of spend.

Either way, it’s critical to take the time to find exactly the right provider partner who understands the industry, the geography, and the market, and has the experience and digital tools ecosystem that are proven to provide specific financial performance business outcomes and bottom-line impact, whatever the economy has in store.

The concept (and reality) of CFO-as-digitization-driver is important to understand more fully. To that end, it is well worth listening to this Corcentric Conversation between Kelly Barner of Art of Procurement and Matt Clark, President and COO of Corcentric. They discuss the changing CFO role and how a broader commitment to digital payments, procurement, and other tools is critical in steering companies through economic upheaval.

If you’re interested in how Corcentric can help you increase your holistic approach to working capital management through streamlined, integrated procurement, accounts payable (AP), accounts receivable (AR), and payments solutions, contact us to learn about our technology, managed services, and advisory offerings.

1 McKinsey, The New CFO Mandate: Prioritize, Transform, Repeat, December 2018

2 CFO.com, Managing Spend to Help Navigate a Recession, August, 2022

Contact us to get started.