How to extend supplier payment terms

Corcentric

All organizations are interested in improving their working capital. One popular method of doing this is through the reevaluation of supplier payment terms. There are clear benefits to paying invoices later, for the organization requesting the extensions.

The practice may be less beneficial to the suppliers involved, depending on how the process is enacted. Extending payment terms essentially kicks the payment can down the road. What’s good for the buyer today may be bad for the seller tomorrow. In turn, what’s bad for the seller could damage your organization’s key supplier relationships.

Successfully extending payment terms requires careful consideration. The process isn’t as simple as a demanding that suppliers accept payment 30, 60, or even 90 days later than is already agreed upon. Organizations that move to extend these terms without a sound strategy are often surprised when that kicked can starts kicking back.

The value of extended payment terms

Extending supplier payment terms is an excellent way to improve working capital. Organizations that have more cash on hand are more agile and this capital can be allocated to priority projects quickly, spurring innovation to stay ahead of competitors. Organizations looking to grow can also channel these resources into expanding operations. Finally, a healthy cash flow is a boon to investors and cash frees an organization to buy back stock as well.

These are all specific outcomes, which is a key element of a strong strategy. Too many organizations seek to extend terms without considering the goals that improved working capital is intended to achieve.

Swinging blindly for the fences, hoping to extend as many payment terms as far as possible, is rarely effective. Define your objective:

-

- Why is an extension of payment under consideration? Why now?

- If cash flow must be increased, what is the specific target to hit?

- Which suppliers should be focused on? Smaller companies may be more amenable, but increasing terms on small invoice totals may not move the needle.

Answering these questions is the start of building a successful strategy.

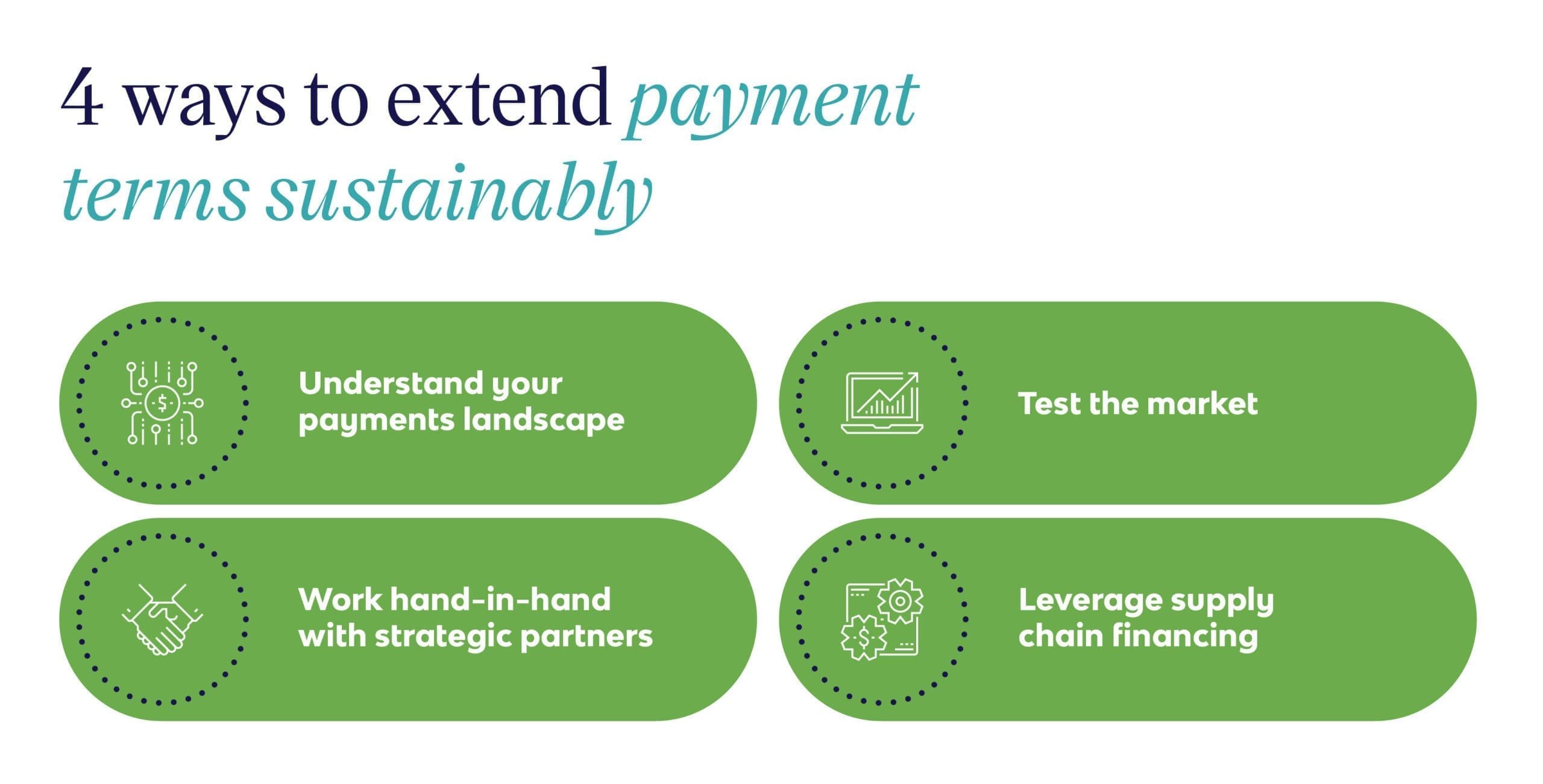

Extending payment terms sustainably

Once goals and overarching strategy are defined through the questions above, an action plan to achieve those goals must be formulated.

Understand your payments landscape

Many organizations have some level of Procurement siloing and decentralization. When this happens, it isn’t uncommon to see that payment terms vary widely within a spend category, or even with a single vendor.

Payment terms can’t be realistically extended if there isn’t a baseline of current cycles. Conducting a spend analysis with an eye on payment terms can shed necessary light:

-

- Low hanging fruit would be any single supplier that is paid through a combination of terms. Standardizing to the longest terms is a clear business case.

- At a wider angle, spend categories should be analyzed. Are most suppliers paid net-60? There may be a path forward to bring those few “upon-receipt” suppliers in line.

Test the market

Sound procurement practices should always include regularly testing high-spend suppliers against the market. An organization’s focus at these times is commonly set on securing the best price. Focus should be expanded to what competitive suppliers are willing to offer by way of payment terms as well.

Part of this analysis should also include the exploration of early payment discounts. Whether an organization opts for price reductions through early payment or extended terms to improve cash flow, negotiations during a market event should seek to keep options open for the future.

Work hand-in-hand with strategic partners

Extending payment terms can be painful, particularly for smaller suppliers. Strategy must account for the impact these terms will have on our most important suppliers.

Make sure key suppliers understand the reasoning for the extended payment term request. Messaging and optics are important, and demanding better terms without describing the benefits to the supplier can only damage a relationship. If the cash will be used to expand operations, explain the long-term opportunity for increased business.

Organizations should avoid creating supply chain risks for the sake of better cash flow. Work with suppliers to better understand their cost cycles, and work in good faith to align extended terms to these cycles. This helps ensure longer terms are viable for the life of the relationship.

Leverage Supply Chain Financing

Extending payment terms offers a one-sided benefit in the short term. For a buyer to take advantage (hold onto cash longer), the seller has to be put at a disadvantage (face a cash flow crunch on their end). However, there is an option that offers the best of both worlds.

Supply Chain Financing establishes a third party between the buyer and seller. Once an invoice is fulfilled and payment due, this third party pays the supplier rather than the buyer. In turn, the buyer pays the third party at a later date.

The introduction of this third party adds flexibility to the relationship. Organizations can extend payment terms while at the same time reducing the amount of time it takes suppliers to get paid. Ultimately, this means more liquidity for both buyer and supplier, increasing efficiencies across the relationship.

Key considerations

There are several concerns organizations must consider before enacting any of these strategies:

-

- Consider who holds the negotiating leverage. Suppliers that corner their markets may not play ball as easily. When push comes to shove, such suppliers may also favor a competitor who pays faster.

- Keep a close eye on non-fixed costs and price changes between renewals. Suppliers that accommodate extended payment terms may need to rely on loans to do so. Interest from these loans, as well as the risk incurred by accepting longer payment terms, may be factored into product costs.

- Don’t extend terms unilaterally. Smaller suppliers may be less able to operate under extended terms. If a small-yet-important supplier can’t afford the change, a supply chain risk is created. Many firms have a month of cash reserves or less, and late payments are a significant contributing factor to business insolvency.

- Consider longer-term change management. Ensure that extended payment terms are a corporate mandate, and that all buyers understand the need. Extending payment terms today accomplishes nothing if buyers erase this progress during annual contract negotiations months later. Likewise, buyers may bring in new suppliers under shorter terms that constrict cash flow.

Moving ahead with extended payment terms

Extending payment terms can be a boon to an organization’s cash flow, when done the right way. Too many organizations fail when they don’t consider the full implications of this strategy.

Whether utilizing a Supply Chain Financing partner or negotiating directly with suppliers, organizations must ensure that a strategy has long-term viability. Corcentric is positioned to support the development and execution of this strategy through our consulting services, technology solutions, and Supply Chain Financing. Reach out today to learn more.