Digital-driven CFOs: Which technology to scale up, scale back or scrap

Corcentric

In Part One of this blog series, we looked at the first half of a report based on a survey of 250 Chief Financial Officers (CFOs) of mid-market and enterprise companies about their investments in digitization since March 2020, titled Digitization Strategies: How CFOs Are Prioritizing Digital Payments To Maximize Efficiency.

The goal of the survey, a collaboration of PYMNTS.com and Corcentric, was to learn how CFO respondents, as well as treasury and finance teams, prioritized digital payments and other technology to focus on their most critical operations and business outcomes. The report showed conclusively that the companies that committed to digital transformation across payments, AP, AR, and procurement, and did it early, achieved much better outcomes during two years of pandemic-induced economic challenges and volatility.

Now, in Part Two, we’ll explore how the learnings achieved by corporate finance leaders regarding digital technology during disruption is now shaping their future strategies for the finance function—especially considering that almost 90% of them feel a recession is coming in the next six-to-twelve months.

Tech-forward CFOs are building resiliency into financial operations

Peter Lynch, the legendary investor, said a lot of great things, including this gem: “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

While he was referring specifically to financial instruments, the parallels for CFOs investing in digital payments and other technology are strikingly apt. As the rapidly burgeoning leaders in process and functional digitization in companies, CFOs know better than anyone the role that the successful adoption and integration of digital tools plays in achieving ROI in a reasonable timeframe.

This doesn’t necessarily mean the “pays for itself in x years” type of ROI either. In fact, based on the PYMNTS.com survey, the focus on what to scale up, scale back or scrap seemed more dependent on achieving a range of sought-after business outcomes. This specificity of goals, rather than just a general proof of technology value, is both critical and integral to developing resiliency in an overall digitization strategy.

It is also encouraging, as it shows that digital-driven CFOs aren’t viewing technology as a set-it-and-forget it proposition. They are proactively looking at their digital initiatives to not only see what’s working and how it’s working, but more importantly why something is working. What constitutes success depends of course on the type of company, its size, and industry.

This agile mindset leads to agile processes and operations, allowing financial leaders to quickly pivot and concentrate efforts to capitalize on current market, economic, and competitive trends. In terms of whether a recession is looming, how much of an impact it has, and exactly how it plays out geographically, 80% of CFOs report that economic uncertainty is an important factor in their digital investment plans for the near- and long-term.

See How CFOs are Focusing on Digitization Strategies

Future investing—where CFOs are putting their digital technology dollars

A digital-powered proactive approach positions CFOs to make faster decisions to meet business challenges, seize growth opportunities and maximize financial performance. According to the PYMNTS.com survey, 82% of CFOs plan to invest in technology to improve the management of their working capital and credit functions. If they’re seeing economic challenges ahead, then that makes perfect sense — you’d want your working capital and cash flow situation airtight.

Not surprisingly, an even larger percentage plan to increase investments in procurement process digitization over the next few years. Getting your cash flow in order means managing spend and maximizing cost savings. And in today’s supply chain-challenged environment, where there is also a severe talent shortage, technology has to play a starring role in the optimization of sourcing and procure-to-pay.

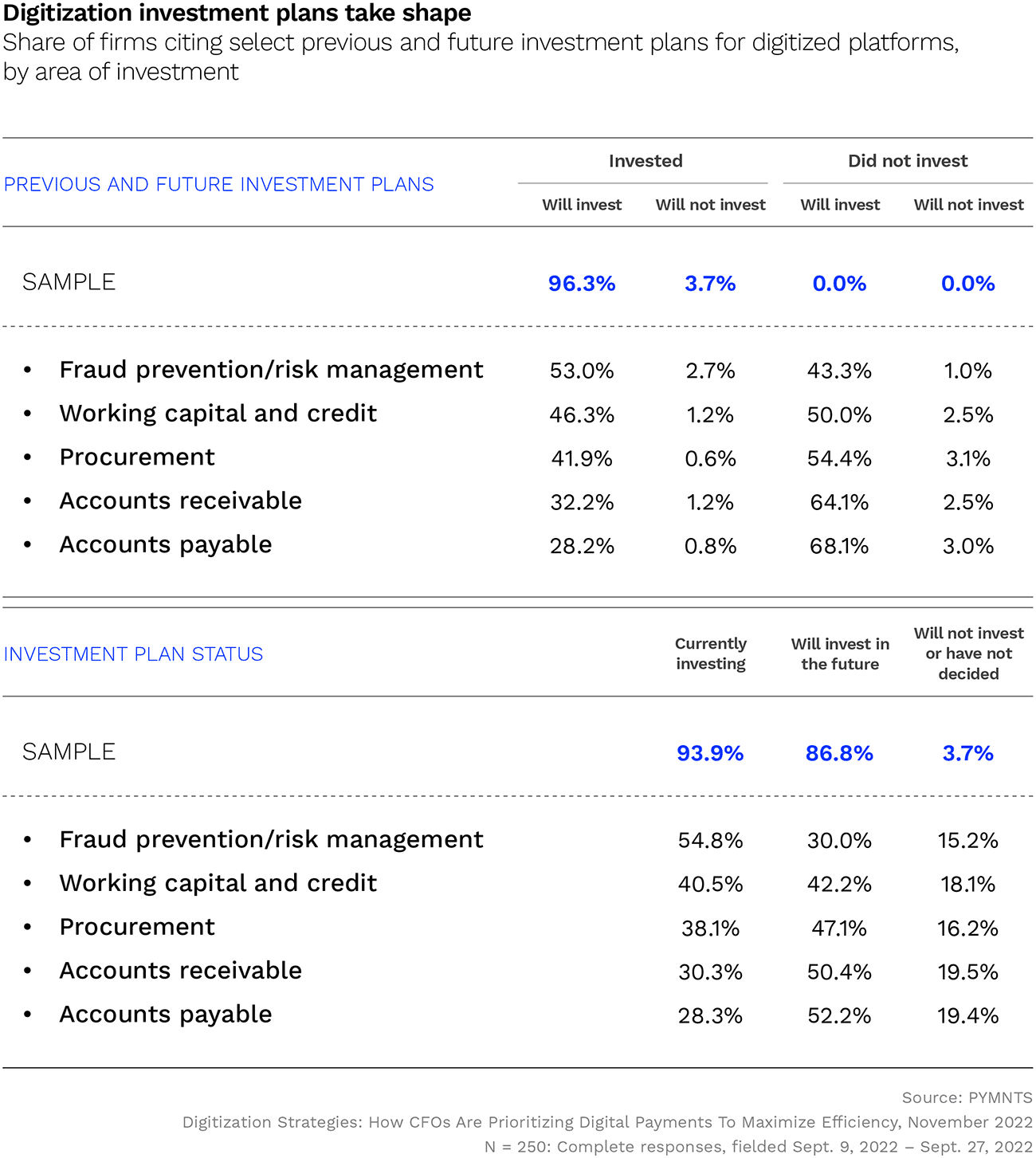

As the report states, CFOs see the same micro- and macroeconomic risks as everyone else, but in greater detail. And not just the data detail, but where those risks will have a direct bearing on company financial operations, business plans, and the bottom line. So, in addition to working capital and procurement processes, the following table shows how CFO proactivity is playing out, digitization wise:

Two things that immediately jump out from the chart are 1) the primacy of fraud and risk management, and 2) the holistic nature of the digitization efforts. Naturally, when economies get tight, CFOs want to ensure protection against financial scams and especially cybersecurity threats. This is the same strategy that was evident during the pandemic disruption, when business went ecommerce and workforces went remote. Lesson learned, for sure.

But seeing financial operations from a holistic viewpoint is still a growing area in our experience, so it is reassuring that CFOs are taking that big-picture view of end-to-end financial processes in order to best accommodate digitization efforts.

Four out of five CFOs plan to continue investing in digitized technology

for their financial operations. For the majority, concerns about

economic uncertainty are key to their investment decisions.

Selectively scaling back certain financial digitization investments

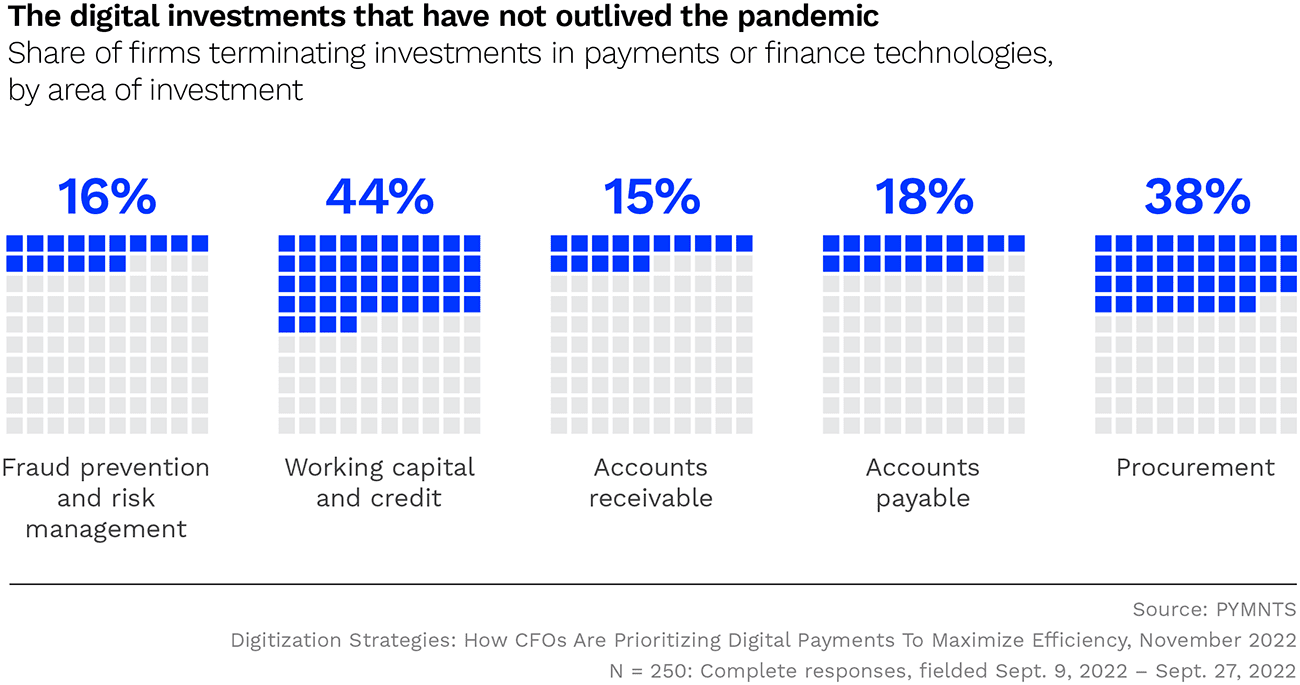

During the economic challenges of the past two years, financial teams became intimately acquainted with their digital technology investments in a “this is not a test” environment. To paraphrase Peter Lynch’s quote, CFOs see no point in wasting time and resources by watering weeds, so in some cases companies are cutting back digitization investments that they made early in the pandemic. The survey analysis doesn’t give specific details on why or how much, but quite likely financial leaders were not seeing that trend toward ROI referenced above.

And of course, budgets play a crucial role in tech triage, so CFOs are going to keep the consistent winners while minimizing spend on less valuable digital tools. According to survey data:

The above can feel a bit contradictory to other survey results, so likely this means more of a shifting of digital investments than an outright elimination. Finance and treasury teams learned a lot about various applications, so they now know better what’s worth the continued investment. There has always been a need to balance short-term goals and long-term resilience in companies, and that is just as true with technology commitments.

Maximizing payments efficiency with existing headcount and new technology as the economy slows

Without a doubt, as the PYMNTS.com survey makes clear, technology can help create efficiencies in an economic downturn. And since CFOs are prioritizing digital payments to maximize efficiency, then those who invest wisely now will have a much more solid footing should a recession materialize. And even if it doesn’t, for that matter.

Technology is table stakes in today’s global economy, and an innovative financial leader already knows the need to evolve strategies to stay competitively ahead. But the agility that builds resilience can also mean looking beyond digital tools — potentially embracing managed services and advisory offerings as well. This goes back to achieving technology ROI, and the reasons for why CFOs are scaling back (or even scrapping) investments in certain areas.

As the trope goes, technology is not a strategy. But having a solid technology strategy is imperative. And that includes understanding that disparate point solutions can generate as many issues as they are meant to solve. Indeed, CFOs are becoming more digital savvy, and are often the drivers behind digitization efforts company wide. But embracing innovation and automation to keep thriving can mean looking beyond the technology itself to better capitalize on it.

To stay agile and resilient without having to invest heavily in new technology and headcount, companies can meet an array of challenges through managed services as part of a wider strategy. Achieving consistent, sustainable outcomes, whether in cash flow, payments, invoicing, sourcing, etc., can be a lot more attainable with technology enabled managed services. This alleviates the burden of digitization by “in-sourcing” the tools and expertise to expand in-house financial and treasury teams, without giving up control.

Managed services isn’t something that was covered in the Digitization Strategies: How CFOs Are Prioritizing Digital Payments To Maximize Efficiency survey, but it is worth considering as an addendum to or replacement for the expense of technology initiatives in reaching that maximum efficiency goal.

In Part Three of this blog series, we’ll look at how CFOs are focusing on procurement and the spend side of the financial continuum, and what that means for financial and procurement teams, regardless of a looming recession or not.

Meanwhile, keep calm and carry on…optimizing working capital and cash flow management with digitization.

If you’re interested in how Corcentric can help you achieve an array of business outcomes in working capital management, cash flow, procurement, AP, AR, and many other areas, contact us to learn about our technology, managed services, and advisory offerings.

Contact us to get started.