5 characteristics of Best-in-Class AP departments

Home - 5 characteristics of Best-in-Class AP departments

Corcentric

If you ask finance leaders whether they’d like improved efficiency, accuracy, and cost reduction in their accounts payable department, it’s a safe bet that most, if not all, would say, “absolutely.” So, what is it that propels some organizations to not only meet goals but exceed them? Why do some AP departments reach “Best-in-Class” status while others fall behind?

In this, the second part of a three-part blog series on Ardent Partners’ The State of ePayables 2023: Paving the Way for a Smarter Future, we’ll explore the five main characteristics that differentiate high achievers from the rest. Where the first blog focused on the first two parts of the report, the latest trends and advancements in AP and ePayables, this blog focuses on the practices and attitudes of those enshrined with ensuring that vendor invoices are paid accurately in the most effective manner and at the right time…every time.

The report surveyed 190 AP and finance leaders between March and May 2023 and used both in-person interviews and written responses to reveal participants’ strategies and intentions. Ardent Partners used this information along with operational and performance results to define what Best-in-Class means when it comes to benchmarks.

The back office no longer takes a back seat

For far too long, accounts payable was considered a back-office cost center, necessary for business to continue but not a function that could necessarily move the organization forward. Those in the C-suite now recognize that a well-run and technology-infused AP department can do more than simply approve and pay invoices. It can drive innovation, reduce costs, and increase visibility into cash positions, all which help the department play a strategic role enabling the leadership to make better-informed decisions.

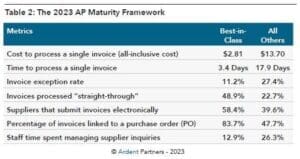

But judging how your AP organization is doing means measuring key performance indicators (KPIs). Comparing those metrics to Best-in-Class AP organizations is how leaders can assess the performance and improvement in their own AP teams. Ardent Partners defines Best-in-Class performance as “the 20% of enterprises with the lowest average invoice processing costs and shortest average invoice-process cycle times.” The chart below shows what a challenge it can be for AP organizations to catch up to those that have Best-in-Class status.

Best-in-Class technology adoption

Businesses understand that manual data entry and paper-based invoice and payments processes result in inefficiencies and are time-consuming, costly, and fraught with the possibility of human error. In order to improve performance of their AP processes and overall payables processes, many companies are increasingly automating their routing and approval workflow processes, regardless of whether or not they merit best-in-class. Using technology to improve your AP invoice approval process (and your balance sheet) is obvious. But not every AP organization will have the same adoption rate. In the chart below, Best-in-Class and all others are very close to one another in only two specific functions: document imaging/scanning and automated routing and approval workflow. However, when it comes to adopting other solutions and technology, Best-in-Class adoption far outpaces the rest.

By embracing these solutions and being open to the latest effective technology, Best-in-Class AP is able to deliver superior performance for their company and for their suppliers as well. Processing costs and time are reduced; visibility is increased, and exceptions (which are the bane of AP departments) are far fewer.

It is important to note that the report states that it’s not just technology adoption that differentiates Best-in-Class AP organizations. What sets these teams above the rest is their adherence to rigorous process and their ability to attract top AP talent. Without the right people in the operation, technology is simply a tool that is not being wielded to its full potential.

Areas where Best-in-Class AP organizations excel

In addition to cost reduction and increased efficiency, there are specific AP functions where the difference between Best-in-Class and the rest are stark.

- ePayables – Organizations that have a robust electronic payables component are able to streamline their payment processes. This not only improves management over cash flow (and ultimately working capital) it also speeds up the overall transaction process, and this, in turn, helps to ensure better supplier relations. As a comparison, 81% of Best-in-Class organizations have this capability versus 70% adoption for others.

- Two and three-way matching – The three-way match (purchase order, receipt, and invoice) is the gold standard for AP accuracy, ensuring that the payment made is correct. (When a PO is not issued, a two-way match of receipt and invoice will do). Manual processes make this burdensome and time-consuming. Automation enables visibility into the status of every invoice so besides ensuring accuracy, an automated 3-way match reduces discrepancies and increases invoice reconciliation efficiency. Nearly 70% of Best-in-Class AP have this capability compared to 61% of all others.

- Straight-through processing – The most cost-effective and time-efficient way to process invoices is by having them go through as few steps and approvers as possible. Automation solutions that have effective matching capabilities allow invoices that match (within agreed-upon parameters) to pass straight through to the ERP for payment without human intervention. Staff then only need to address exceptions and other discrepancies. The comparison here is eye-opening. While 69% of Best-in-Class AP possess this capability, only 29% of the rest do so.

- Remittance information – Maintaining strong vendor relationships is essential to doing business and being able to offer transparency and supply accurate, timely, and rich remittance information goes a long way towards promoting trust and loyalty. Best-in-Class shines here with a 65% capability. Only 38% of the rest can do the same.

- Track and report key metrics – This blog focuses on the metrics but without the ability to accurately report those metrics, the numbers are meaningless. Best-in-Class are constantly monitoring and measuring their performance in order to identify areas of improvement. An impressive 54% of Best-in-Class do this while only 38% of the rest have this capability.

The 5 main characteristics of Best-in-Class AP

What seems evident is that talent, technology, and the dedication to following rigorous and standardized processes combine to enable organizations to experience higher ROI and gain greater control over their cash flow and working capital. Ardent Partners identifies five specific characteristics that the Best-in-Class AP organizations share.

-

Holistic approach

From the point an invoice is sent to when it’s received all the way through to payment, top performers view the transaction path holistically rather than as individual steps. This approach eliminates any silos that may exist intra- and inter-departmentally.

-

Continuous improvement

Those rated as top AP departments take a proactive approach to performance improvement. They are constantly enhancing processes, continually looking at and analyzing data, measuring their KPIs, and staying on top of industry trends. Tracking this can also identify bottlenecks before they can create major problems.

-

Strategic vision

Best in-Class AP operations work closely with the CFO and others at the executive level to understand the company’s business needs and goals as well as the goals within their own department. They will ensure that their present and future plans align with those of the organization.

-

Technology adoption

The statistics shown above make clear the advantages gained by adopting technology and then developing the proficiency to optimize that technology. Best-in-Class make technology the centerpiece of their operations.

-

Process efficiency

AP is about process, so any practice and technology that results in more efficient and effective processes should be adopted. What is vital is that these processes become standardized so that everyone involved follows the same steps. This will lead to lower costs, faster approvals and payments, fewer exceptions, and greater visibility.