What’s happening with the used truck market?

Corcentric

For fleet owners and fleet managers, it’s been a roller-coaster ride over the past three-and-a half years when it comes to having the right fleet vehicles in the right class at the right volume for their fleet. From the days of the pandemic, where the economy relied upon trucking more than ever resulting in more trucks being bought, to the supply chain disruption which then reduced the number of available new trucks and led to more used trucks being acquired, to today which presents a whole new set of problems.

Since newer trucks weren’t available, fleets were purchasing or leasing more used vehicles, and that obviously drove up used truck prices. So much so, that in the 18 months starting a few months after the pandemic started, used truck prices doubled and then tripled. But what goes up must come down, and that is holding true for the used truck market as more new vehicles become available thus depressing the resale value for older assets.

Where is the used truck market headed now?

Since late last year, the industry is clearly in a freight recession resulting in excess capacity. Spot rates cratered and even contract rates are starting to suffer. There is a significant amount of parked fleet that need to be sold. So, lots of used trucks and trailers to sell and fewer buyers out there. The net effect in a supply and demand world is that used truck pricing has collapsed. Since this time last year probably close to a 60% sales price reduction.

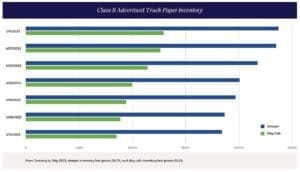

Because trucks and trailers continue to be idled, these assets are hitting the used market in large volumes all at once, thus leading to significant decreases in market prices. The Truck Paper has featured a 52% increase in class 8 sleepers advertised to sell and a 69% increase in daycabs from January 2022 till now. This is simple economics and the result is pricing has dropped dramatically, by over 50%! One thing to remember when you look at this drop in price, significant though it may be, is that prices almost tripled from the height of the pandemic in the Spring of 2020 until the end of 2021.

The Truck Paper chart below illustrates how the volume of available sales inventory has grown throughout the year.

There are other reasons for the drop in pricing

There is rarely one thing along that will cause a situation like we currently face. In this case, freight started catching up to demand while the economy also slowed down due to inflation and increased interest rates. Now the new truck production has improved considerably. With this extra production, some major fleets are now able to retire some of their trucks, thus adding to the used market glut. In addition, with the drop in freight and the increase in fuel costs, smaller fleets as well as many Owner-Operators have been forced to sell their heavy-duty trucks, increasing the volume of available used vehicles.

ACT Research Vice President, Steve Tams, has recently been quoted saying that used truck prices could drop another 40% in 2023. That is a dramatic drop following this earlier dramatic drop. Add to that, the latest interest rate increase and overall economic uncertainty and you can see that this might be the right time to be quite proactive in selling any idle or soon to be idle trucks or trailers.

Turn to Corcentric to dispose of your used assets

Obviously in a falling market, you want to get the best price possible in the shortest timeframe for your commercial vehicles, but fleet disposal can be a difficult chore and a time-consuming burden. That’s why many fleets turn to Corcentric when it comes time to sell their used trucks. With our decades of experience and our network of more than 6,000 qualified truck buyers, disposing of used assets has never been easier.

When you work with Corcentric Fleet Remarketing, we manage the sale from start to finish. We handle the advertising and marketing. We take care of all the necessary paperwork, including inspections, titling, and delivery. Bottom line: we can get you the best price and fastest possible sale, with almost no effort on your part, so you can focus on your core business.

For more information, contact Dale Tower at [email protected]