Enhancing supplier management with nightly TIN/OFAC screenings for fraud prevention

Bill Dorn

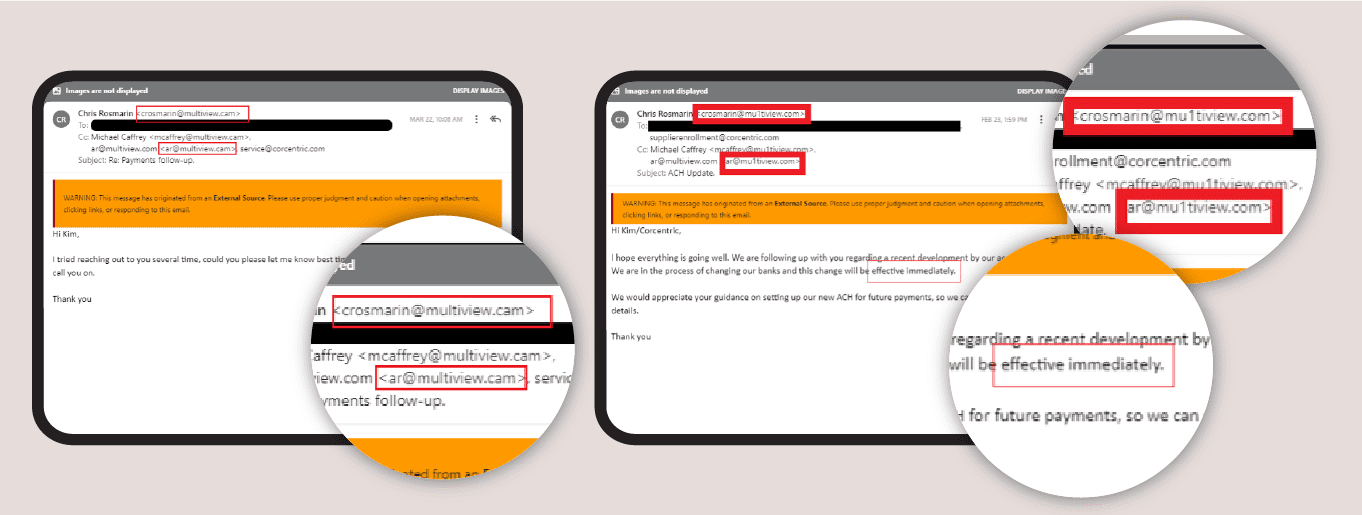

Would you like to play a game? It’s called a Tale of Two Emails. The rules are simple, but the stakes are very, very high: Just see if you can spot the differences between these two emails.

No doubt you spotted the spoof right away. Considering that an estimated 3.4 billion phishing emails are sent every day, you’ve had a lot of practice. Unfortunately, so have the fraudsters. They’re constantly getting smarter, and their tricks? Shockingly convincing.

As much as we’d like to say, “don’t become a statistic,” the odds are getting skewed: According to CISA1, within the first 10 minutes of receiving a malicious email, 84% of employees took the bait by either replying with sensitive information or interacting with a spoofed link or attachment.

You can see above just how subtle the difference between a legitimate supplier email and a phishing attempt can be. As you’ll see later in this article, a leading company learned how to not “take the bait,” since they are a valued Corcentric client taking full advantage of our StopFraud™ and Supplier Management solutions.

Whether you “won” or “lost” the game above, you’re already on the right path to understanding why supplier validation isn’t just a checkbox exercise, especially in a supply chain context where trust and speed are essential. It’s a mandatory exercise for companies tiptoeing through the minefield that is today’s risk-filled supply chain landscape.

That means supplier management is no longer simply maintaining a list of preferred vendors and negotiating favorable terms. It’s about securing your business against financial threats, reputational damage, and compliance headaches.

And the first step? Comprehensive, consistent supplier validation.

Why supplier validation is a non-negotiable issue

Ever heard of vendor impersonation fraud? It’s not just a headache — it’s a multi-billion-dollar problem. Like the example above, fraudsters pose as legitimate suppliers, send a few convincing emails, and before you know it, funds are wired to fraudulent accounts. According to the FBI, business email compromise (BEC) schemes caused $2.4 billion in losses in 2021 alone.

Then there’s the risk of regulatory noncompliance. Without proper validation, companies can inadvertently engage with sanctioned entities or suppliers flagged for unethical practices. The fallout can be severe: hefty fines, legal challenges, reputational damage, and operational disruptions. On an operational level, unvetted suppliers can cause costly delays in procurement, manufacturing, or delivery, affecting everything from production schedules to customer satisfaction.

It’s a perfect storm that no business wants to face — or needs to.

How TIN and OFAC screenings slam the door on fraud

This is where TIN (Taxpayer Identification Number) and OFAC (Office of Foreign Assets Control) screenings come into play. Yes, they are something of bureaucratic hoops to jump through — but more importantly, they’re also vital tools for fraud prevention and risk mitigation.

- TIN screenings: These act as ID checks at the door. Every supplier’s TIN is cross-referenced with IRS records to verify their legitimacy. This weeds out fraudulent entities attempting to pose as bona fide vendors.

- OFAC screenings: These scans ensure your suppliers don’t appear on U.S. government watchlists. Whether it’s sanctioned organizations, terrorist groups, or other high-risk entities, OFAC screenings provide a crucial layer of protection against regulatory violations.

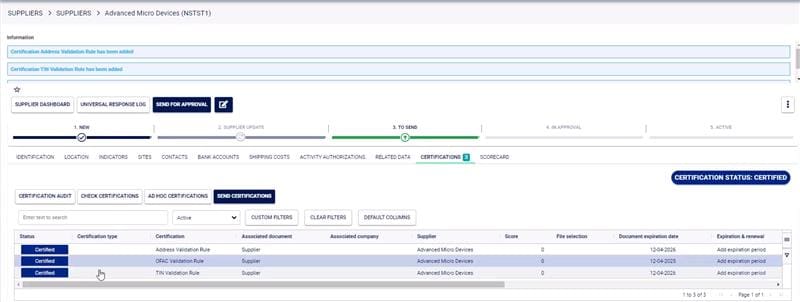

But here’s the kicker: manual screenings simply can’t keep up with the volume and complexity of today’s supply chains. Nightly automated screenings, like those offered by Corcentric, take this process to the next level. Nightly screenings ensure businesses always have current data, enabling them to respond proactively to changes in supplier risk profiles. By continuously cross-referencing supplier data in real time, these systems identify red flags before they escalate into financial or legal nightmares.

Automating this process eliminates the time-consuming and error-prone nature of manual checks. By integrating these screenings into their supplier management workflows, businesses gain real-time visibility and reduce the likelihood of compliance violations or fraudulent activity slipping through the cracks.

The case for human-powered automation in supplier validation

Fraud thrives in the shadowy cracks inherent to outdated, manual processes. Inconsistent checks, human error, and reliance on static data create vulnerabilities that fraudsters are all too eager to exploit. Automation fills those gaps with speed, accuracy, and consistency.

Here’s the thing, though: while automation is critical for scaling supplier validation processes, it’s not the whole picture. Human expertise remains essential for interpreting results, providing context, and making informed decisions — especially in complex or high-stakes situations.

For instance, automated screenings might flag a supplier based on incomplete or ambiguous data. A human reviewer can assess whether the issue requires escalation or if it’s simply a false positive. Similarly, when a supplier fails validation due to a minor discrepancy, expert oversight ensures the situation is resolved without unnecessary disruption.

At Corcentric, our human-centric supplier management platform lets automation handle the repetitive screenings and tasks, while skilled professionals focus on delivering nuance that require judgment and industry-specific knowledge. With this balance, businesses can integrate TIN and OFAC screenings into a broader, automated framework that consistently delivers:

- Efficient onboarding: Automation ensures every supplier starts with a clean slate. Duplicate records, incomplete data, or discrepancies? All flagged and resolved before they become issues.

- Real-time compliance monitoring: Supplier risk profiles can change overnight. Automated nightly screenings provide up-to-date insights, ensuring that yesterday’s safe vendor isn’t today’s risk.

- Fraud detection at scale: AI-driven tools analyze patterns and anomalies that would take human teams hours—or days—to identify. From invoice fraud to BEC schemes, automation acts as a vigilant sentinel for your supply chain.

Building trust through proactive supplier management

While supplier validation is about protecting your business, it’s also about building trust. A well-validated supplier network signals to customers, investors, and regulators that your operations are secure, ethical, and above board.

Consider this: A global manufacturing firm partnered with Corcentric to revamp their supplier validation process. By automating TIN/OFAC screenings and adopting Corcentric’s fraud detection tools, they reduced fraud risk by 40% in just six months. The result wasn’t just operational efficiency — it was a stronger reputation as a trustworthy partner in the supply chain ecosystem. As global supply chains become increasingly fraught, that trust is what will mean the difference between the haves and can’t haves.

Beyond TIN/OFAC: The full validation toolkit

While TIN and OFAC screenings are foundational, effective supplier management doesn’t stop there. Comprehensive validation includes additional layers of due diligence:

- Credit checks: Assessing a supplier’s financial health can reveal risks like insolvency or default, helping you avoid partnerships that could jeopardize your operations.

- Background verifications: From verifying business registrations to confirming ownership structures, these checks ensure you’re dealing with legitimate and ethical suppliers.

- Industry-specific requirements: Different sectors have unique risks. For example, counterfeit parts in tech or unregulated sources in pharmaceuticals demand tailored validation measures.

Corcentric’s platform integrates these elements into a seamless process, creating a robust defense against fraud while ensuring compliance with industry regulations.

Turning supplier management into a strategic advantage

Fraud prevention and compliance are critical, but they’re only part of the story. With the right tools, supplier management becomes a strategic advantage. Here’s how:

- Improved cash flow: Validated suppliers are less likely to cause disruptions, enabling smoother payment cycles, and better cash flow management.

- Stronger relationships: Proactive validation fosters trust and collaboration, turning suppliers into strategic partners rather than transactional vendors.

- Data-driven decision-making: Real-time insights into supplier performance and risk profiles empower finance leaders to make informed, confident decisions.

In short, effective supplier management isn’t just about avoiding pitfalls — it’s about creating value.

It’s better not to DIY your KYS

The saying, “it’s not what you know, but who you know that counts” when it comes to business success is, at best, outdated.

In this era of AI, data dependency, and cyber shenanigans, the saying should really be, “It’s not who you know, but what you know about them that counts.”

Business, and societies as a whole, are built on trust. And as you know, trust but verify. And verify. And verify. And keep verifying, because continuous vigilance is how you avoid risk and fraud.

Supplier risk and performance management have been a part of the Corcentric brand since the early days. As the regulatory environment has gotten stricter, Know Your Supplier (KYS) strategies have played a pivotal role in helping our clients stay many steps ahead in verifying the identity and assessing the risks associated with suppliers before entering into business relationships.

There are many instances where companies are responsible for risks created by 3rd parties, especially in government contracts and relationships. If not for robust supplier management solutions and automation, that burden would keep a lot of companies from participating in otherwise beneficial business. Real-time data is key, and Corcentric’s KYS capabilities are integrated across source-to-pay modules, including:

- Supplier Information Management

- Contract Management

- Procurement

- Invoicing and Payment

This integration allows for a seamless flow of supplier data throughout the entire source-to-pay process, providing greater visibility and control over supplier relationships.

Game on: Supplier confidence

The challenges of modern supplier management are real, but so are the opportunities. By embracing automation and integrating TIN/OFAC screenings into a comprehensive validation process, businesses can protect themselves from fraud, maintain compliance, and build stronger, more resilient supply chains.

It’s a continuous process, but one that pays dividends in trust, efficiency, and long-term growth.

So, the next time you receive an email from a “supplier,” you’ll have the tools—and the confidence—to know exactly who you’re dealing with.

1CISA.gov, Cybersecurity & Infrastructure Security Agency