10 best practices to manage your accounts payable effectively

Home - 10 best practices to manage your accounts payable effectively

Corcentric

10 AP best practices: Tips for improvement

For far too long and far too often, accounts payable (AP) has been regarded as simply fulfilling a necessary but somewhat repetitive back-office function. Invoices come in; payments go out. But as CFOs and other finance executives have come to appreciate the added value that AP can provide (ex. improving cash flow), there has been a push for those departments to develop and institute best practices.

Every AP department should strive to become a best-in-class department; to do that, it is necessary to transform the way the overall AP process is handled; foremost, how it handles invoice processing, from data entry to invoice matching to approval workflow and, finally, to payment.

According to Ardent Partners’ Accounts Payable 2023: BIG Trends and Predictions Report, for AP departments to thrive in these challenging times, it is crucial to keep up with current trends. Some of the areas that need focus include automation and hyperautomation, supplier relationships, cash flow and payment terms, and global e-Invoicing mandates.

Understanding the accounts payable process

Companies now understand that, although the accounts payable process is just one step in the entire procure-to-pay (P2P) transaction cycle, it is the one step that is responsible for ensuring payments are accurate, timely, and free of fraud.

Essentially, the AP department receives invoices, and the data on those invoices needs to be captured and coded with accurate accounts and cost center data, either through automation or manual keying. Then those invoices need to go through a three-way match or two-way match against purchase orders and, when possible, receiving notices. At that point, the invoices are either sent straight through to your ERP or AP system or routed to the appropriate people for approval and then posted for payment.

That doesn’t even begin to address how much time an AP department spends on invoicing issues like handling exceptions, addressing supplier requests for payment information, tracking down paper (PO and Goods Receipt), and tracking down approvers to ensure that payment is made on time.

There are steps you can take, however, to eliminate or minimize those issues that keep your AP department from being the best it can be.

10 best practices to optimize accounts payable

When you optimize accounts payable by streamlining invoice processing, you can create a situation where invoices that are accurate are automatically sent straight through to the ERP or accounting system for payment, with no human intervention so the AP department can instead focus on exceptions.

That additional time saved can be used to find ways to increase cash flow, improve supplier relationships, reveal advantageous payment term opportunities, and better manage working capital.

Each of the ten practices below are ones every AP department must focus on to ensure that payments made are accurate, timely, and free of fraud.

1. Try a paperless automation solution

Each of the practices in this list should be followed, whether or not you automate your processes with an AP software solution. However, the reality is that optimizing these practices, and thus your processes, becomes much more likely when you eliminate paper invoices and manual processes that are inherently costly, time consuming, and subject to human error.

No matter the size of your business, when your AP department transitions to digitizing and utilizing AP automation software, you will quickly recognize the benefits process automation affords, including the reality that the cost to process an invoice is $2.94 for best-in-class AP organizations vs. an average of $15.96 for the rest.

Processing invoices takes time. Automating the process takes the burden of following invoices out of the hands of your processors and into a system that will handle the steps automatically, including matching. If you have seasonal spikes in invoice volume, an automated solution lets you scale up response without having to hire additional employees.

2. Organize and prioritize invoices

Depending on the size of your business and the volume of invoices received, keeping track of what needs to be paid and when is essential for managing cash flow while avoiding late payments, which can negatively impact supplier relationships. When setting priorities, obviously invoices should be paid in order by the due date and payment terms.

If you have hundreds or even thousands of invoices appearing weekly, or if you have a seasonal business where invoice volume spikes, it can be difficult to ensure timely and accurate payments. It’s also necessary to match the invoice against the purchase order and receipt of goods (if applicable). You don’t want to push through an invoice for payment until you verify the product is received and matches the invoice, or that the service has been performed.

You should also be aware of early payment discount opportunities, which many suppliers offer. Since AP automation considerably speeds up the approval process, you will be able to identify and capture early payment discounts. If there are no discounts, then it is preferable to pay an invoice on time, though not earlier than it is due, to better manage your cash flow.

3. Streamline your workflow

The more complexity in the system, the likelier for errors or late payments. Look at your existing workflows and identify where bottlenecks are occurring in the approval process. Streamlining the approval process also means centralizing and standardizing processing and reporting across the organization.

Paper and manual processes tend to slow things down. AP automation can reduce the invoice processing time by up to 70%, while ensuring the accuracy and timing of payments. It’s essential that your AP department have detailed rules in place, even with automation.

Companies that have multiple locations with purchasing capability need to ensure that all invoices go to one centralized location for processing and payment. If you are still running on a legacy manual system, you may want to limit your number of check runs to two per month.

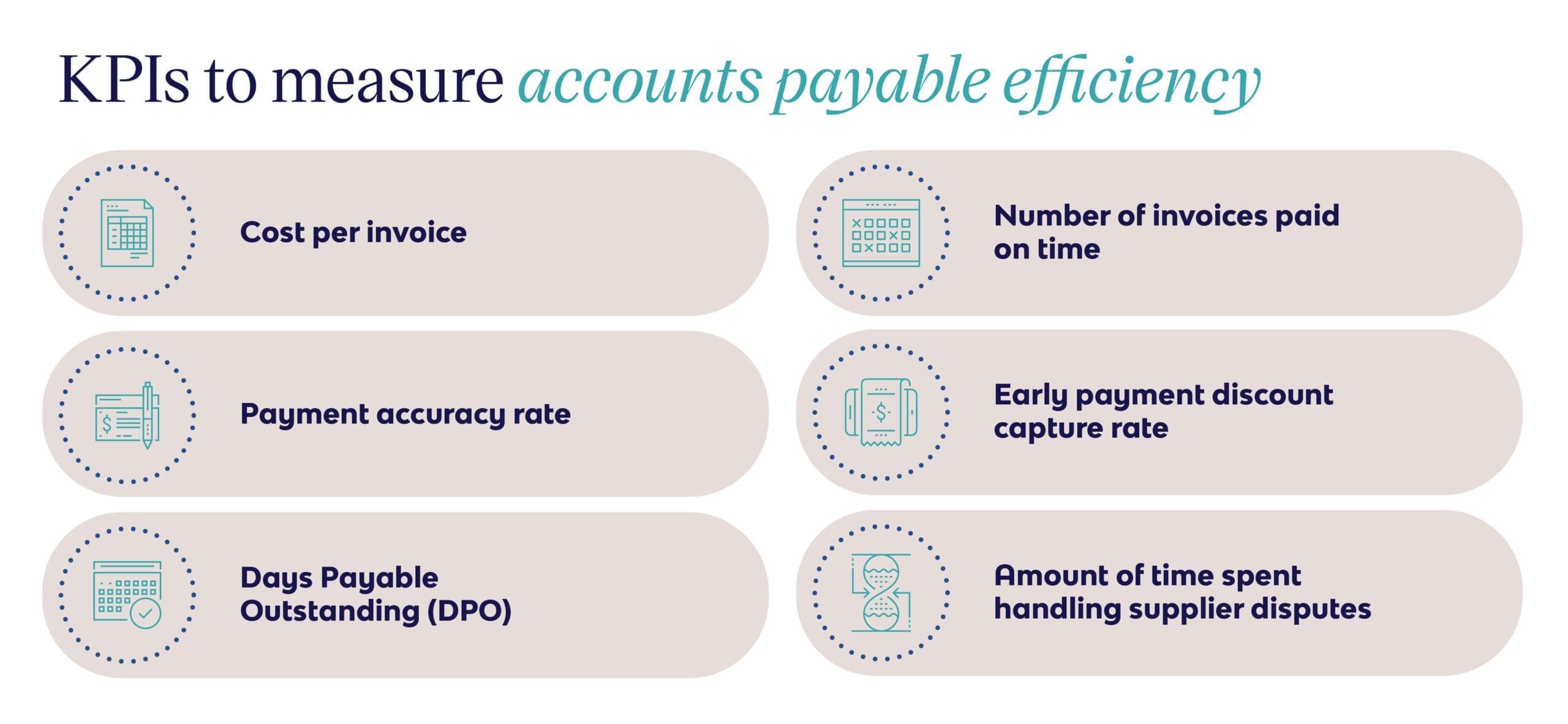

4. Use KPIs to measure accounts payable efficiency

You can’t manage or make better what you can’t measure. So, if you make changes to your processes, set up specific goals and KPIs to measure how your department is adhering to the new or revised processes, especially once you’ve automated those processes.

Start by assessing where your department is currently when it comes to specific metrics indicated below. Then, measure how the department is performing after implementation of an automated system. Metrics you should look at include:

-

- Cost per invoice

- Payment accuracy rate

- Days Payable Outstanding (DPO)

- Number of invoices paid on time

- Early payment discount capture rate

- Amount of time spent handling supplier disputes

Ongoing measurement will exhibit the value of AP automation. However, not automating should not be an excuse for not tracking metrics. The only way to assess improvement is to continually benchmark AP team’s performance.

5. Establish reliable fraud detection

When dealing with money, there is always the possibility of fraud. Fraud can come from a number of sources: cybercriminals, suppliers, even your own employees. And when paper checks are the source of payment, the chance for fraud is even higher. That is why mitigating that risk is directly tied to following policies and procedures.

Cybercriminals have a wide array of scams that are not necessarily a way to hack into your organization, including where they will mimic the email address from a supplier and ask for payment to be routed to a different account. Employers can set up dummy supplier accounts; suppliers may have their own employees who attempt the same.

Accounts payable automation helps combat this challenge with a more rigorous approval tracking system and a clear audit trail. Real-time visibility into the status of every invoice and automated 3-way matches will catch discrepancies and outright errors and flag those for further investigation.

6. Create safeguards for duplicate payments

The steps for eliminating duplicate payments are much the same as the way to detect and combat fraud, except here the situation is usually not intentional. Again, manual processes and paper can mean that duplicate invoices get sent through for payment. A supplier may send an invoice by mail and then email the same invoice to ensure it is received. With manual systems, especially if you get a high volume of invoices, an employee may key in both invoices for payment.

Your payable system should red-flag the duplicate invoice, stopping payment. That assumes your system will catch most if not all duplicate payments. If you are handling invoice approval manually, you cannot simply rely on the system; you need to have AP continually check to avoid duplicate payments. Transitioning from manual to automated processing will eliminate duplicate payments.

7. Firm up access controls

The more people that have access to the payables process, the more likely errors and duplicate payments can occur. Combat this by implementing internal controls, including setting up a distinct separation of duties per employee; that no one person has control over all the steps (from invoice approval to payment); and that only specific people have access to the Master Vendor File. Implement internal AP review processes that will expose where mistakes and bottlenecks are occurring.

System-level controls help identify and address structural inefficiencies in the process which will help avoid security breaches and detect potential fraud. Again, since automation limits the need for multiple human interaction, there will automatically be fewer people involved in the process.

8. Standardize payment terms as much as possible

When you work to standardize payment terms, you free up working capital, gain greater control over cash flow, and optimize payment processing. This is especially important when dealing with a high number of suppliers, each of whom wish to negotiate their own payment terms. Standardizing terms helps to make your workflow more efficient. It also prevents ad hoc negotiations with individual suppliers that can negatively impact your DPO, affecting the payable department’s bottom line.

However, instituting standard payment terms shouldn’t preclude renegotiations. Your team should do its research and ensure that your supplier is offering the same or better terms than it offers similar businesses. If you are operating at a disadvantage, then it is time to renegotiate. Although invoices generally come in on a 30, 60, or 90 day cycle, you may find that taking advantage of early payment discounts outweighs the benefits of an extended DPO.

You should also consider payment methods when negotiating with suppliers. Reducing the number of paper checks cut and mailed will reduce costs and late payments due to delivery issues. Instead consider centralizing and managing 100% of your vendor payments electronically via a variety of payment methods, including ACH, wire, or virtual card.

9. Track and resolve disputes effectively

Exceptions continue to be a major challenge for AP; they result in delayed payment and often, an inordinate amount of time handling supplier inquiries and concerns (both by phone and via email). Resolving these issues quickly is essential to maintaining a necessary cash flow. An automated approval process will send invoices that match POs directly into the ERP for payment, leaving only exceptions for your AP team to handle. Since those exceptions are quickly identified, they can be resolved on a timely basis.

Streamlining how you track and resolve disputes is a win-win for you and your suppliers. On-time payments result in good relationships with suppliers. Conversely, tracking disputes may lead to identifying suppliers who constantly have problems and may lead you to look for alternatives. On your side, the less time employees spend on answering phones and emails translates to more time they can spend on value-added tasks.

10. Keep supplier information up to date

In a global business environment, suppliers may be acquired, contacts may change, and companies can relocate. Any and/or all of these end up with an invoice not being recognized in the system and that can lead to delayed payments or worse, payments being sent to the wrong address.

An AP automation solution that offers a supplier portal will eliminate those issues since suppliers will be able to go into the system and make any changes necessary. This will, however, necessitate that both your solution and the one used by suppliers are compatible.

Following these practices and constantly improving the AP process will help streamline the approval process, eliminating late payments (and late fees), and ultimately, giving you greater control over your cash flow. But paper and manual processes will only make achieving your goals more difficult. Implementing an accounts payable automation solution is the way to move your AP department to the next level and, eventually, to best-in-class status.

Corcentric’s industry-leading AP automated solution will help you process invoices up to 70% faster, reduce invoice processing costs by up to 80%, handle 100% of payment disbursements, capture early payment discounts, eliminate fraud and duplicate payments, ensure regulatory compliance, enable cash flow visibility, and provide accurate reports based on real-time information for better cash management, visibility, and spend management.

Once this happens, your AP team can handle exceptions more efficiently and dedicate time to more value-added tasks. That’s how you turn a back-office cost center into a revenue generator.

Read the Ardent Partners’ Accounts Payable 2023: BIG Trends and Predictions Report, for more insights on how AP can break the stereotype and play an important role in boosting the organization’s bottom line.

Get started today, Contact Us.