The importance of procure-to-pay (P2P) for businesses

Corcentric

Understanding procure-to-pay (P2P): definition, process + benefits

If you run any business, from traditional to digital to a blend of each, it is essential that you understand the procure-to-pay process and the automated systems that can help harness it.

From the time a product or service is ordered until the time an invoice is paid, your procurement and accounts payable teams should be able to check the status of a transaction at any point.

In this article, we’re going to talk a lot about that procure-to-pay continuum – what it means as well as the process and benefits of using digital software to help.

What is procure-to-pay?

At its most literal level, this is the process whereby a requisition is made, an order is placed and, once the order is received, payment is made based upon an invoice from the supplier.

What procure to pay (or P2P) actually refers to is an automated system that integrates procurement with accounts payable in order to streamline the process, ensure accuracy, and create efficiencies in cost and time.

One example of this is Corcentric’s Procure-to-Pay software.

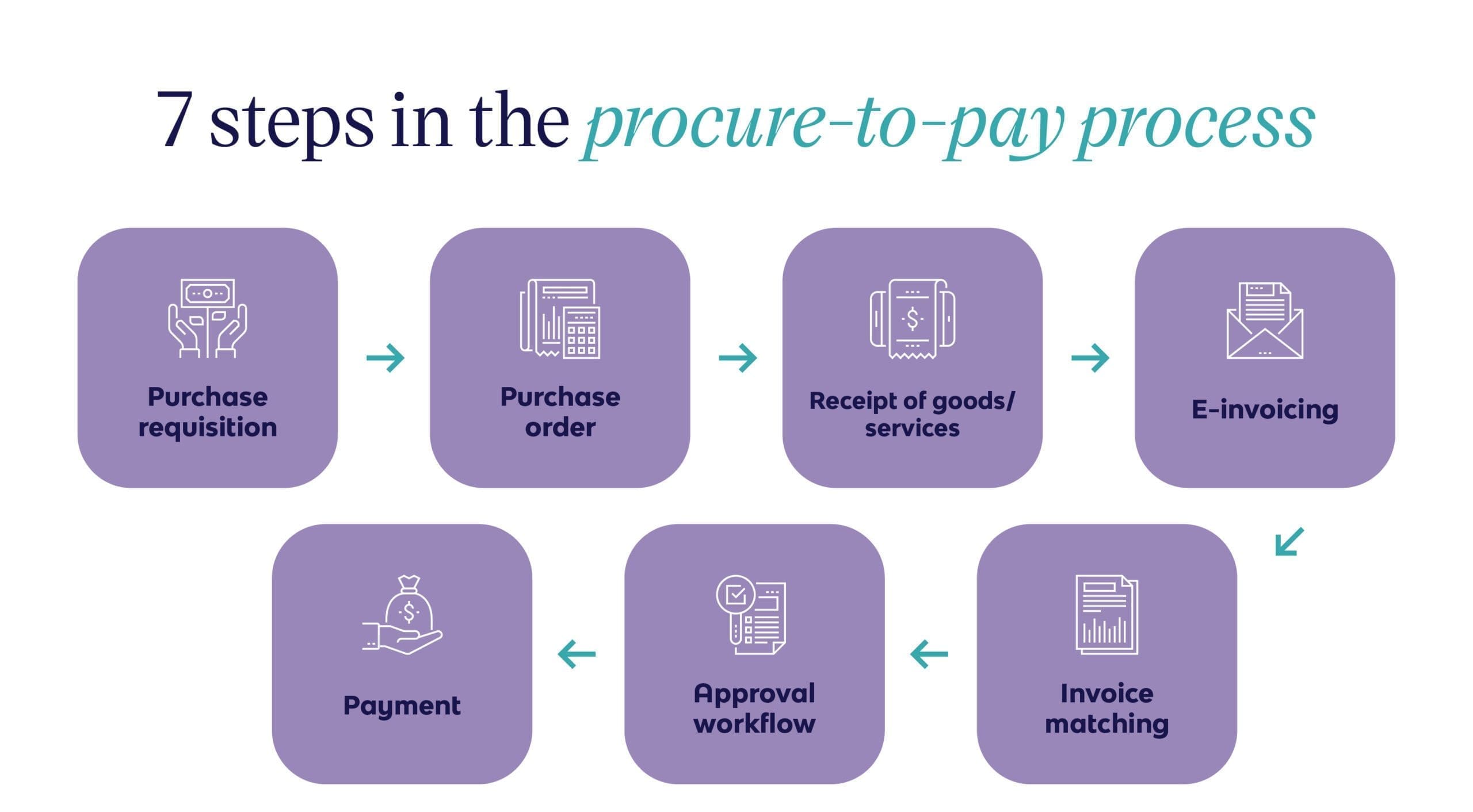

The 7 steps in the procure-to-pay process

The seven steps below make up the basic steps in the P2P process. One thing to note, however, is that not all businesses use purchase orders for every purchase.

Our belief is that the lack of POs can lead to significant losses when spread over an entire organization. In addition, companies that have not implemented a digitized system to automate this business process are still subject to human errors that often accompany a dependence on paper and manual processing.

These companies also experience delayed payments due to disputes, and a complete lack of visibility into the real-time status of invoices.

- Purchase requisition – once a need for a specific product or service is identified and approved by management (in any department in the organization), that request goes to the procurement department. Requisitioning is essentially the need that kicks off the P2P process.

- Purchase order – Procurement departments will first go through its list of approved suppliers and based on the requisition data, select the best supplier for the purpose. The Procurement department then creates a purchase order (PO) in the system that is automatically routed for approval and transmitted to the supplier. This is most effective with electronic purchase orders.

- Receipt of goods/services – upon shipment of goods or completion of service, the supplier will send an invoice to the Accounts Payable department. Once the shipment is received, Procurement will enter shipment information into the system.

- E-invoicing – all the steps up to this point have been handled by the Procurement department; here is where the Accounts Payable department steps in. Invoices are sent by the supplier either electronically through the supplier portal that is part of the P2P solution or via mail, email, or fax. If the supplier is not using electronic invoices, they go through a process of scanning and double-blind keying technology where relevant data is extracted, standardized, and converted to electronic invoices (e-invoices).

- Invoice matching – the e-invoice is then automatically matched against the PO and receipt of goods. As long as all items match within agreed-upon thresholds, the invoice is automatically advanced for approval. This is often referred to as two or three-way matching, and is an important piece of any P2P system.

- Approval workflow – with an automated P2P solution, invoices that pass the two-way or three-way match are put straight through to the organization’s ERP for payment. An invoice approval workflow solution can automate this process. If established rules stipulate that invoices above a certain dollar amount need additional signatures, the solution will automatically forward those invoices to those people and alert them that a signature is needed. Those invoices will then automatically go into the ERP system for payment as well.

- Payment – payment methods may vary from company to company. Although we feel that electronic payments like ACH and virtual credit cards are the most efficient and cost-effective way to pay suppliers, many companies still rely on paper checks and cash. A procure-to-pay solution should offer an e-payables functionality, however, a company can still decide not to use that method.

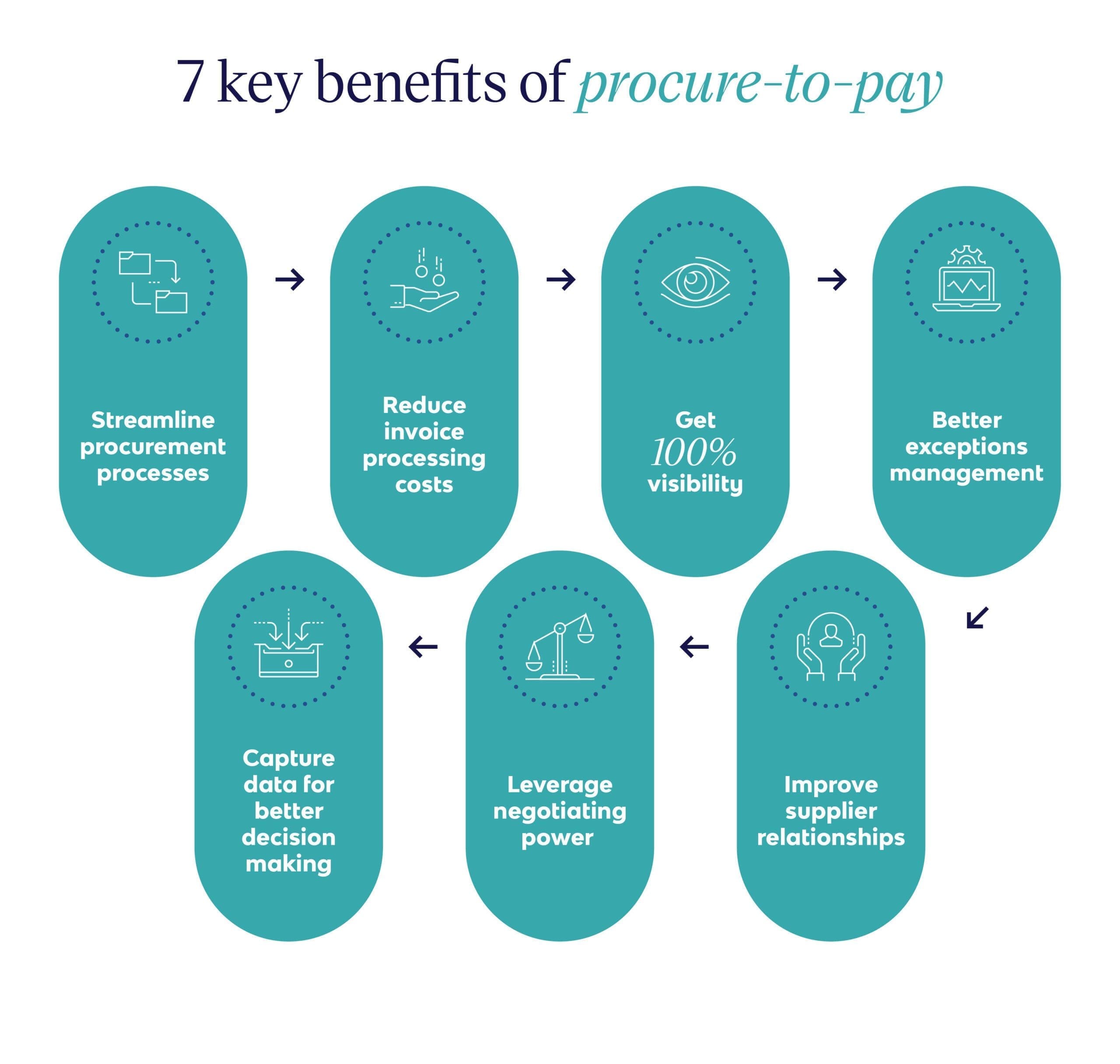

7 key benefits of procure-to-pay

Automating your procure-to-pay processes provides a wide range of benefits for procurement and accounts payable. Below are just some samples of the improvements your company will realize.

E-procurement solutions and P2P go a long way to free up your Procurement teams, improve spend management, and even supply chain management.

- Streamline procurement processes – procurement software provides connectivity throughout the organization so requisitions are requested and approved faster, appropriate suppliers are selected based on data, and POs are produced and sent to the suppliers, all electronically and all easily trackable.

- Reduce invoice processing costs by up to 80% – going paperless reduces time as well as cost, and enables companies to use employees for more strategic initiatives rather than for repetitive tasks better accomplished by automation.

- Get 100% visibility – a P2P solution provides visibility throughout the supply chain, giving both buyers and suppliers the ability to view invoice status in real-time.

- Realize better management of exceptions – with most invoices processing straight through, exceptions can get the attention they deserve and get resolved faster.

- Improve supplier relationships – by utilizing the supplier portal, suppliers can know when they will receive payment and that gives them the information necessary for better decision making. Quicker resolution on invoice exceptions and disputes also engenders goodwill and allows buyers to gain greater visibility.

- Leverage negotiating power – when suppliers have confidence in their payment status they may be willing to offer terms that are more advantageous to buyers while still ensuring that suppliers have the revenues they need to grow their business.

- Capture data for better decision making – robust P2P solutions offer robust on-demand reporting capabilities. By using real-time and historical data provided, companies can gain greater control over cash flow and working capital.

Get started with Corcentric’s P2P solution

Your organization should be investing in purchase-to-pay technology, optimization of data, insight into historical trends, and analysis of your supplier base.

Manual processes and silos make payable systems and purchasing processes inefficient and can have a significant impact on your bottom line.

From Strategic Sourcing to Contract Management to AP Automation and more, Corcentric provides holistic solutions that will help you save money, free up cash flow, and grow your business.