A brilliance for resilience: CFOs prioritize digitization to maximize working capital

Home - A brilliance for resilience: CFOs prioritize digitization to maximize working capital

Corcentric

Our latest survey report with PYMNTS.com, Digitization Strategies: How CFOs Are Prioritizing Digital Payments To Maximize Efficiency, reveals the actions that CFOs and finance teams take to improve cash management and financial operations. While the report focuses on how CFOs invested in digitization to weather the economic challenges and disruptions of the past several years and are using that learning to build agile, resilient businesses, the subtext of the survey shows just how much CFOs, finance, and treasury executives are taking a leading role in digital transformation as a whole.

In Part One of this blog series, we look at where and how digitization efforts were initially focused across payments, invoicing, fraud and risk management, and other areas since March 2020, and the resulting impacts on working capital and financial operations. The information provides a preliminary “case study” type recap, while also creating a nascent set of best practices for maximizing efficiency and returns while minimizing the impacts of future disruptions (more about that in Parts Two and Three).

Payments digitization strategies to thrive, not just survive

It may be a little optimistic to say the economic challenges of the past two years are waning, but they are morphing and shifting. Based upon this intense period of experience under fire, CFOs and business leaders have learned to work within the context of disruption to truly hone innovative strategies around digitization. As Darwin discovered, it is the most adaptable that survive. Companies that experienced the least disruption to their invoicing, payments, receivables, and procurement operations were those who adopted digitization early, strategically, and selectively, and adapted their processes and personnel accordingly.

The PYMNTS.com survey included 250 chief financial officers who were queried about their targeted investments in digital technologies to meet the pandemic-induced economic mayhem, dealing with the realities of newly remote workforces, and the necessary increase in eCommerce.

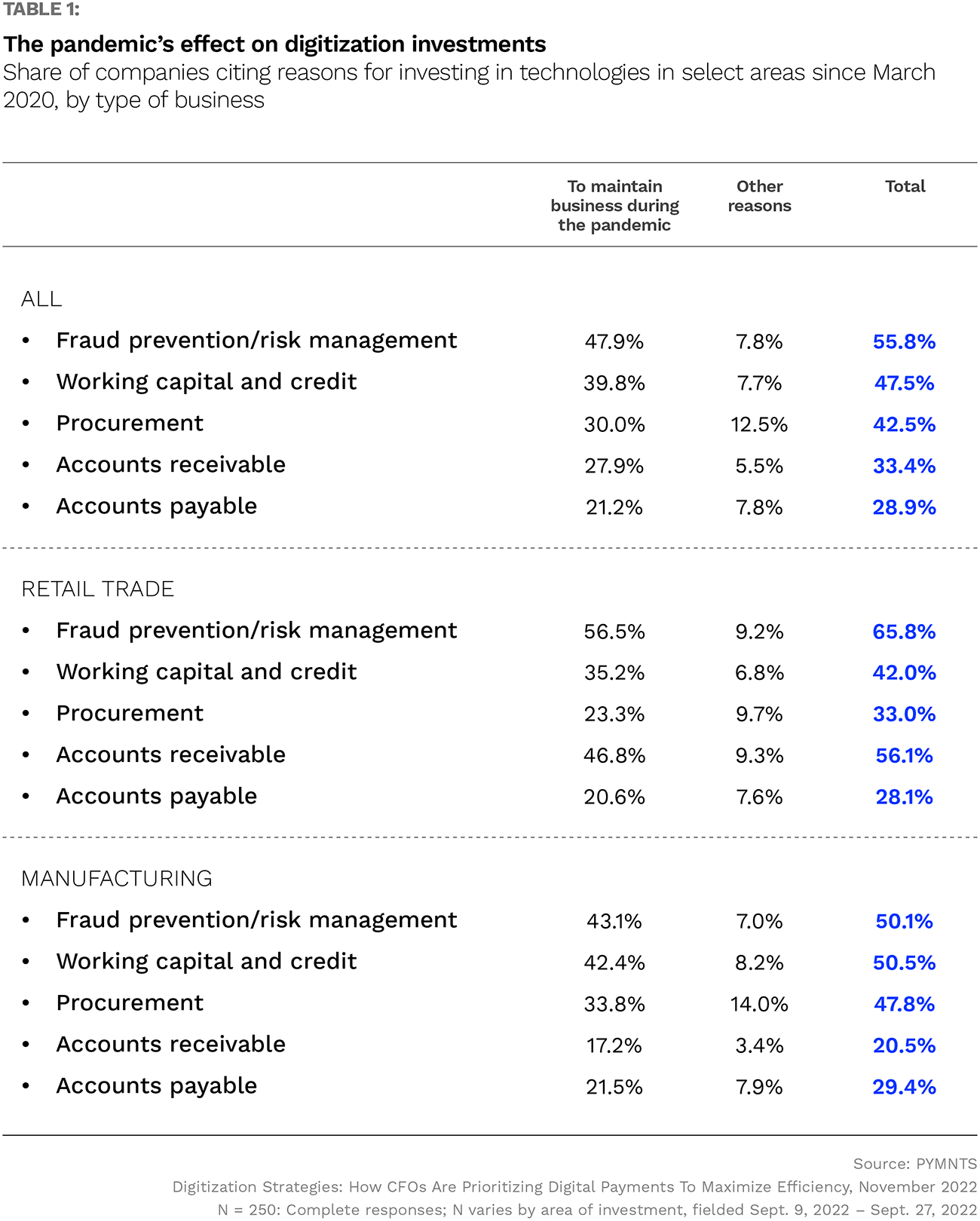

Of course, there is no one-size-fits-all approach to incorporating digital payments, procurement solutions, e-invoicing, and the like, and the report focuses on two industries that are on different ends of an often intertwined continuum: Manufacturing and retail. The reasons for investing in digital technologies were cited as follows:

It is both understandable and curious that, across the board, CFOs focused on investing in, or expanding, existing investments in fraud and risk management technologies at the onset of the pandemic. With no one in the office and teams scattered geographically — i.e., the notion that “no one was minding the store” — the perception that financial operations would be more open to abuse is very valid.

For manufacturers and retailers, industries that deal with a significant number of suppliers, coincidentally, the potential for fraud can take many forms. A 2021 survey by the Association of Certified Fraud Examiners (ACFE) revealed that manufacturing was one of the leading industries with occupational fraud. Retail was less impacted, but certainly not exempt.

The timing of the digitization investment is curious because it begs the question of what CFOs were doing before March 2020 to manage risk and fraud. Since ACFE estimates that organizations lose 5% of their revenue to fraud each year — an average loss of $1,783,000— with a typical case of fraud going 12 months before detection, hopefully there were a stringent set of controls in place.

This could be an illustration of the fact that in previous years, CFOs spent less time on digital issues than traditional financial activities, being content to let IT or other departments take the lead because of a lack of best practices and compelling use cases. Thanks to the pandemic, that has changed dramatically, with CFOs playing a lead role in adopting digital payments and other innovations.

See How CFOs are Focusing on Digitization Strategies

For innovative CFOs, payments digitization pays off

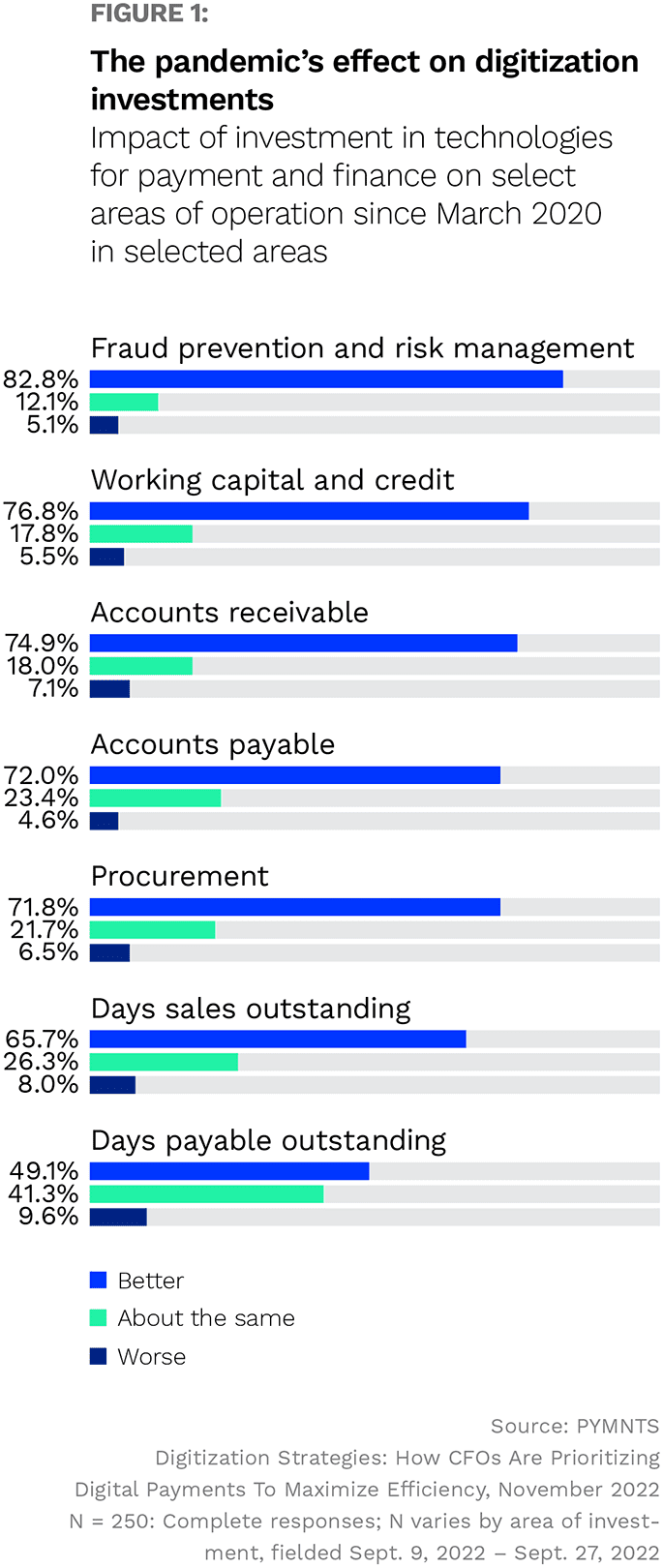

The success of these programs in achieving the desired results is evident in the table below, which shows where the impact of digital platforms improved success across the board in fraud and risk, working capital and credit, AP and AR, procurement, and other metrics. Obviously, financial digitization has proven its value, and CFOs are innovating new strategies to capitalize on their success.

Managing risk and fraud during fraught periods is definitely crucial, but CFOs also focused a lot of effort on cash management to maintain smooth business processes, and in some cases, actually help grow it. While the report does not provide detailed results, it can be assumed that the nearly 77% of CFOs who cite improvements in their working capital and credit over the past two years were in a better budgeting position to seize opportunities that competitors were not, to keep supply chains humming and perhaps grow market share.

What the report does reveal is that data-driven CFOs are increasingly leveraging digitization to liberate cash flow, optimize spend, and maximize working capital across AP, AR, and procurement processes. Those who embraced transformative strategies early in recent years are reaping the results, not only financially, but with increased agility and resilience.

“94% of CFOs are currently investing in at least one area of payments and finance digitization, with 87% planning to do so.”

Abandonment issues: Payments digitization disrupted

As outlined above, so many of the digitization and automation efforts proved invaluable to businesses in protecting balance sheets and maintaining financial operations during the pandemic. In light of that, why are some company finance leaders abandoning their working capital and credit digital solution investments now?

According to PYMNTS.com survey respondents, 44% of companies are deserting digitization initiatives in working capital and credit digital solution investments, while 38% are ditching procurement technologies, at least partially. In the face of a looming global economic downturn, this seems shortsighted, if not somewhat irresponsible. The report does not explain the motives behind these de-digitization moves (which may be a future topic), but we can probably deduce some of the reasoning based on the success rates that were experienced, or not, and shifting budget parameters.

As mentioned earlier, the CFO as a digital leader is a new-ish phenomenon, so the payback from initial efforts — in certain areas, at least — may not be worth the renewed commitment. Or it could also be a case of biting off too much at once, and trying to digitize multiple business processes at the same time leading to not enough focus on optimizing each one. The report states that “as many businesses recovered their equilibrium, they have learned which applications merit continued investment and which they can do without, informing decisions about technology spending.”

These decisions about what to scale up, scale back, or scrap altogether have a direct bearing on the not-too-distant future: almost 90% of CFOs surveyed are forecasting a recession within the next 12 months, and 84% in the next six months. Fasten your seatbelts.

Keeping working capital working in the face of further economic challenges

CFOs were also asked for their input on how current economic conditions — such as inflation and the volatility in the capital markets — are likely to affect their financial performance and well-being in the years ahead. Their response was pretty concrete:

Four out of five CFOs plan to continue investing in digitized technology for their financial operations. For the majority, concerns about economic uncertainty are key to their investment decisions.

CFOs have their fingers on the pulse of macroeconomics, and that gives these financial stakeholders a clearer real-time picture and more detailed information about decision making that impacts profitability and the bottom line. They used that fiscal brilliance to great advantage during the disruption of the pandemic and built more resilient operations in the process. How they are preparing for the potential of a recession is the subject of our next blog in this series.

Outsourcing innovation for payments digitization

Something that we’ve stressed repeatedly over the years, is that it’s nearly impossible to manage fraud and risk in an age of data without having either a) a robust digital platform of integrated solutions, and/or b) a provider who offers “insourced” expertise through managed services. While CFOs are the new generation of digital innovation business drivers, it is faster, easier, and more comprehensive to work with an experienced payments, procurement, order-to-cash, and accounts payable solutions and service provider.

At Corcentric, we provide an unmatched platform that helps mid-market and enterprise companies across industries. If you are in the midst of digitally transforming your financial operations, or need to accelerate your efforts, let us show you how we can optimize how you purchase, pay, and get paid.

Get started by contacting us at [email protected].