Boost efficiency with automated invoicing system

Corcentric

As anyone in AP can attest, invoice management can be a serious drain on time, people, and financial resources when invoice processing uses manual procedures. Many businesses don’t achieve process efficiency in invoicing for just that reason, severely impacting cash flow and the bottom line. As part of a proper invoicing process, invoice automation can slash the cost per invoice and the time it takes to process them as part of a broader accounts payable automation strategy.

“By moving to automated invoice processing, Procurement and Accounts Payable can reap significant cost savings, quality improvements, and data-visibility benefits.” This fact, from the Hackett/Corcentric report Four Dimensions for Measuring Digital Progress in Purchase-to-Pay, makes a compelling case for any organization looking to cut the costs of the invoice process.

The typical invoice process as managed by the accounts payable team comprises of a workflow that extends from receipt through to payment.

-

- Invoice receipt and capture, either manually or with e-invoicing software (OCR), and coding within the general ledger and accounting software program

- Three-way matching of invoices with purchase orders (PO) and receiving reports

- Invoice forwarding through the invoice approval process for acceptance, rejection, or amendment

- Submission of authorized vendor invoices to finance for payment routing

- Invoice payment using EFT, ACH, wire transfer, or check, generally depending on vendor requirements

- Invoice payment archiving for reporting and audit requirements

With so many individual steps for handling invoices in the payable process (even small businesses can have hundreds or thousands per month), it’s easy to see how relying on a manual invoice process adds so much time and potential for human error and mistakes. The cost to organizations can be as much reputational (internal and external) as financial.

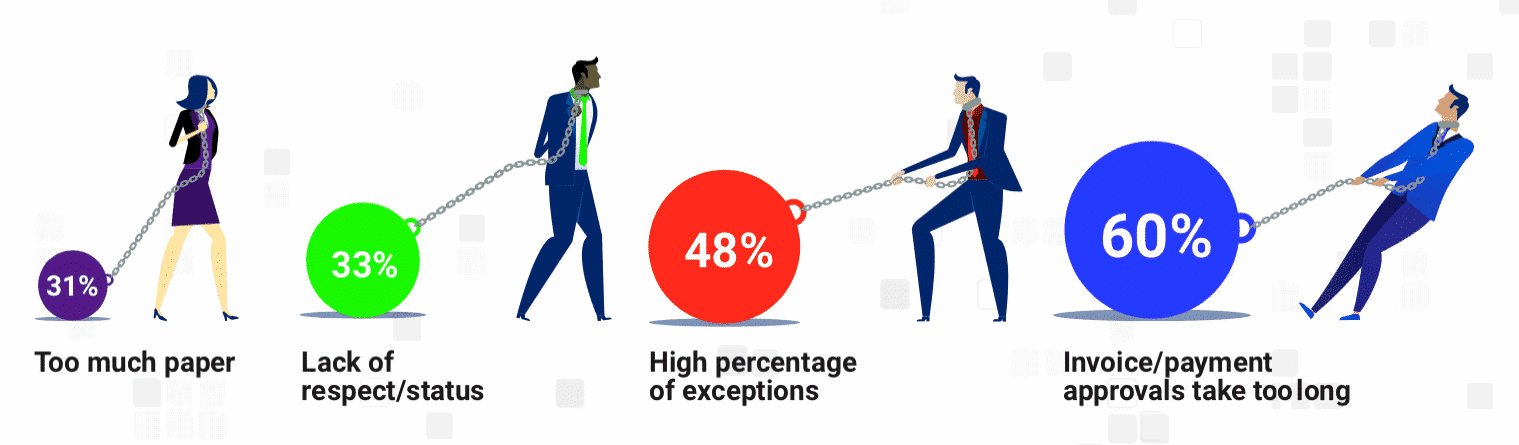

Top challenges holding the AP process back

Source: Ardent Partners’ Accounts Payable Metrics that Matter in 2021

What is automated invoice processing?

Unlike a manual invoice process, invoice processing automation (also known as e-invoicing) streamlines and accelerates the invoice workflow through on-premise or SaaS invoicing software that digitally manages each step.

Instead of relying on dedicated staff to manage paper invoices, automated invoice processing software assists AP teams by doing invoice data extraction upon capture and integrating it with the company ERP system (such as SAP) and accounting systems, along with financial and other systems. This automatically codes each invoice with the correct general ledger (or other) designation, performs three-way-matching to verify each invoice with its requisite PO and receiving report, immediately sends invoices to the correct approvers or approval chain, and finally forwards approved invoices to finance for payment.

Along the way, manual data entry and handling are mitigated or eliminated, speeding up the overall process, and slashing the per-invoice cost, often dramatically. According to Ardent Partners, best-in-class enterprises with departments that leverage AP automation solutions achieve results in invoice processing costs that are 80% lower and 74% faster. Automate to accelerate.

Benefits of invoice processing automation

-

- Improve supplier collaboration for faster onboarding and quicker error resolution

- Increase efficiency while reducing operating costs by accelerating invoice processing, validation, and approval

- Minimize or eliminate paper processes and manual errors

- Optimize and simplify the matching of invoices, purchase orders, and receiving reports

- Better identification of matching mode details – how supplier invoices have been matched and invoices created

- Quick, simple access to invoices enhances payment control and Accounts Payable responsiveness

Boost your digital progress in P2P

Advantages of automatic invoice processing

Best-in-class organizations are leveraging invoice process automation to boost savings and spend management, improve user experiences, increase productivity and efficiency, and ensure continuity in times of business disruption. Here’s how:

Drive efficiency

-

- Automated invoice processing enables data capture directly from invoices and feeds information into the accounts payable system in real time – artificial intelligence (AI) and machine learning make this paperless process even more effective

- Invoices are processed immediately, eliminating bottlenecks while increasing capacity and streamlining invoice processing workflows

- Helps capture early payment discounts, and avoid late payments which can damage supplier relationships

- Reduces instances of time-consuming duplicate invoices and payments

Increase accuracy

-

- Automated invoice processing software eliminates error-prone and slow manual processes and entry procedures through invoice capture that scrapes data directly from invoices, facilitating data integration and verification

Better relationships with suppliers and vendors

-

- A faster procedure for passing through supplier invoices and vendor invoices into the approval workflows without mistakes will improve your company’s reputation and relationship, providing potential competitive advantages

Better cash management

-

- As part of a broader approach to the accounts payable automation process, automatic invoice processing gives finance teams better control over cash flow and budgets because the process improves end-to-end visibility, enabling spend commitments to be managed more accurately against business rules

Using invoice automation software to improve your company

Making invoicing faster, more accurate, and fully compliant through an invoice automation software solution (e-invoicing) is a low-hanging fruit strategy to improving overall enterprise efficiency and resiliency, not to mention an enormous savings generator.

But even beyond those benefits, an automated process ensures invoices are still being managed during periods of disruption or when AP teams have to work remotely. Not only does invoice management technology save time and reduce human error, it frees up people and resources to be better used for more profitable, strategic advantages.

Corcentric Invoice Management creates perfect alignment of Procurement and Accounts Payable with broader business outcomes and metrics. Our invoice automation solution helps improve productivity by eliminating redundant data, accelerating the invoice-to-payment cycle, and resolving matching errors and exceptions.