The invoice approval process workflow outlined

- Home

- The invoice approval process workflow outlined

Home - The invoice approval process workflow outlined

Corcentric

The invoice approval process and how to improve it

Approving invoices should be a fast track process through the Accounts Payable department, one that is seamless, streamlined, and very cost effective. That’s the data-driven, software solution technology-enabled approach. But, it’s not always the case, as any AP or Finance department that’s mired in the inefficiencies of manual invoice processing can attest.

In this age of digital transformation, wasting time, resources, and people with a paper-based, manual invoice approval process is choking off cash flow, risking competitiveness, and negatively impacting the bottom line. Eliminating this costly inefficiency is why so many companies are implementing and leveraging invoice approval process automation.

Not only does automating the invoice approval workflow accelerate validation and approvals, and reduce manual errors (and critical cash flow), but it gives the AP department and the CFO greater insights into overall invoicing, accounting data, and spend for better forecasting and strategic decision making.

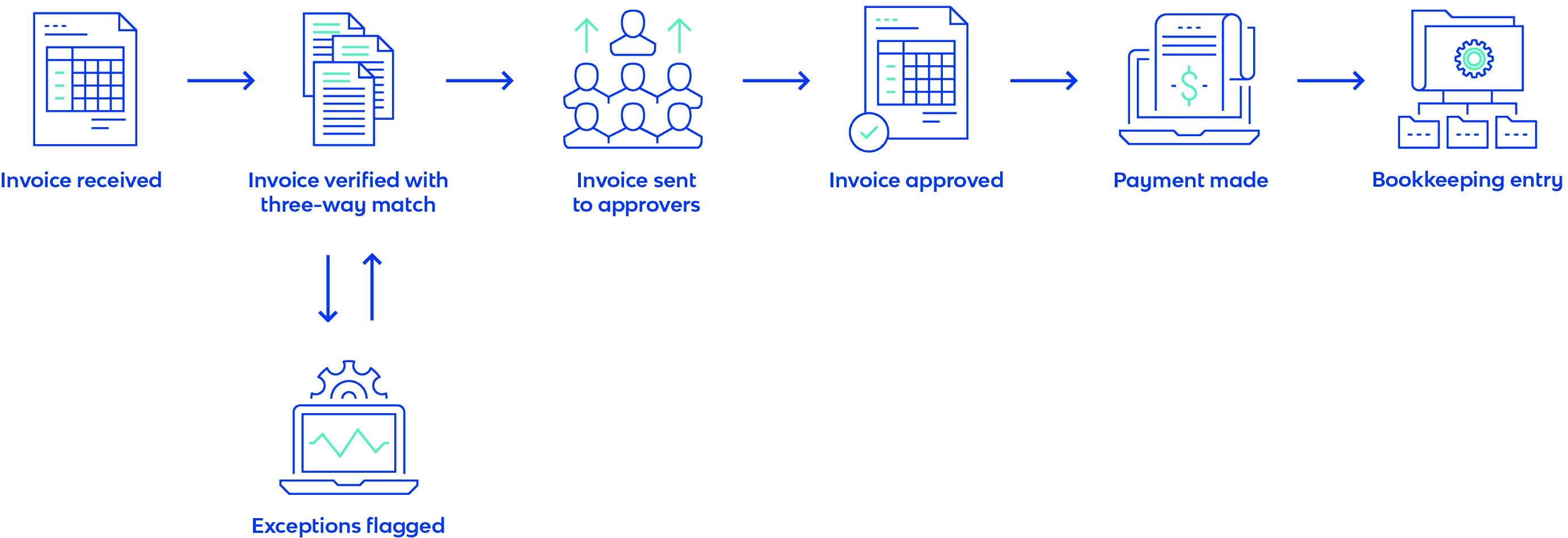

The invoice approval process explained

The invoice approval process is a set of procedures or steps that a company implements before an invoice can be paid – i.e., a system of internal controls to prevent unauthorized payments. It starts when an invoice is received and checked for accuracy, then ideally put through a three-way matching process to verify it against the original PO and receiving report. Dates, amount, and other details must all match exactly.

For many companies, too many in fact in this day and age of digital transformation, the whole invoice approvals workflow process is still mired in email and paper handling. That puts a lot of unnecessary time and distance between invoices coming into a company, approvers finally reviewing them, and an invoice approval (or query) coming back down the line.

In an ideal world, a streamlined invoice approval process would work like this:

The trouble and bottlenecks occur when not all invoicing processes are automated. Here are a couple of examples of where and how Accounts Payable can streamline invoice approvals:

Invoice receipt

Invoice receiving that leverages e-invoicing solution technology replaces the need for manual data entry with automation, thus minimizing errors, increasing speed and capacity, and getting the invoices into the approval process quicker. It also frees up AP teams for more valuable work.

Three-way match

Exceptions can be exceptionally frustrating when they slow down the approvals process. Implementing e-invoice technology that provides three-way match capabilities will help ensure purchase orders (PO), receiving reports, and invoices are all in sync so approvers can verify invoices for payment.

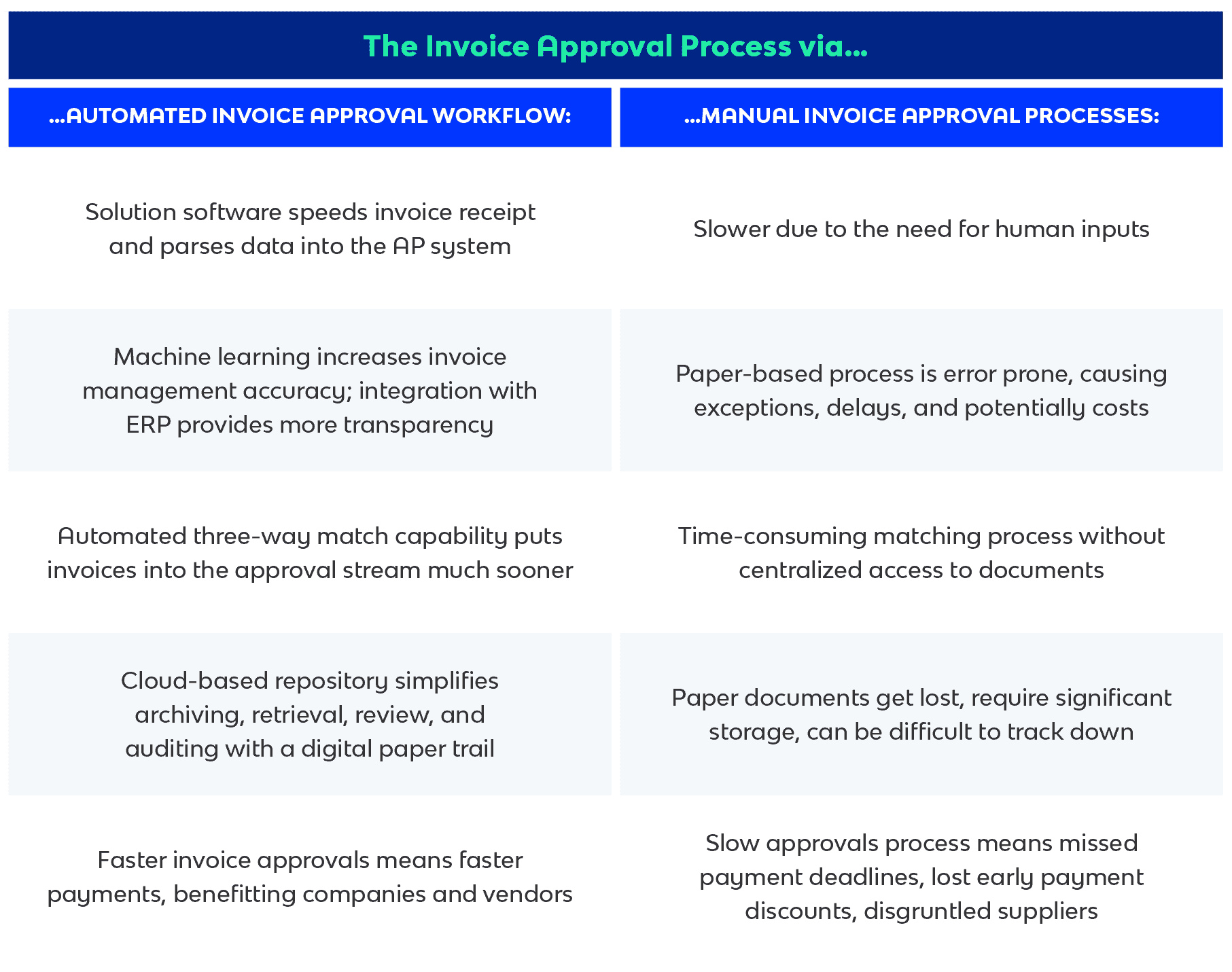

Automated invoicing vs. manual invoicing

Based on the topics covered above, you can see there are obvious advantages to moving from manual invoicing to invoice automation software. The benefits from a day-to-day task point of view are evident, but speeding up the invoice approvals process so third parties get paid faster provides strategic gains in terms of cash flow optimization, supplier relationship management, cost savings, and potential competitive advantage.

Let’s take a look at each in detail:

What is the automated invoice approval process?

Approving invoices through an automated invoice approval workflow is definitely one of the “low-hanging fruit” options for making AP, and companies as a whole, more efficient. While manual invoice approval processes are slow, error prone, and can be fairly disorganized, invoice automation is very much the opposite.

By streamlining business processes, automated systems not only simplify the accounts payable process, they are also more accountable, transparent, and accessible. Some of the most common value-adds from AP automation include securing an audit trail, supply chain visibility, removing invoice approval processing bottlenecks, and an enhanced payment process.

According to the 2020 Payables Insight Report from Levvel Research, most enterprises and some middle market organizations have automated the approval workflow step, but it has remained manual for most SMEs. Survey results show evidence of this changing, as the number of SMEs with manual approval workflow has decreased by nearly 10 percent from 2019 to 2020. This is a good thing, especially during times of business disruption and when implementing a business resiliency strategy. Here’s why:

-

- Invoices are received electronically and centrally, with data parsed automatically

- Automated three-way matching accelerates invoice verification against PO and receiving reports

-

- Invoices that achieve a three-way match are put straight through for payments with no human touches required

-

- Approver workflows mean invoices are routed to exactly the right person quickly

- Data visibility and consistency across company systems provides process transparency and decision-making insights

- Integration with ERP and accounting/finance systems ensures that invoices are applied to the correct accounts and budgets

- Manual errors and fraud potential are eliminated, and exceptions are minimized

- Early payment discount opportunities are maximized

- Processing costs and time are minimized

What is the manual invoice approval process?

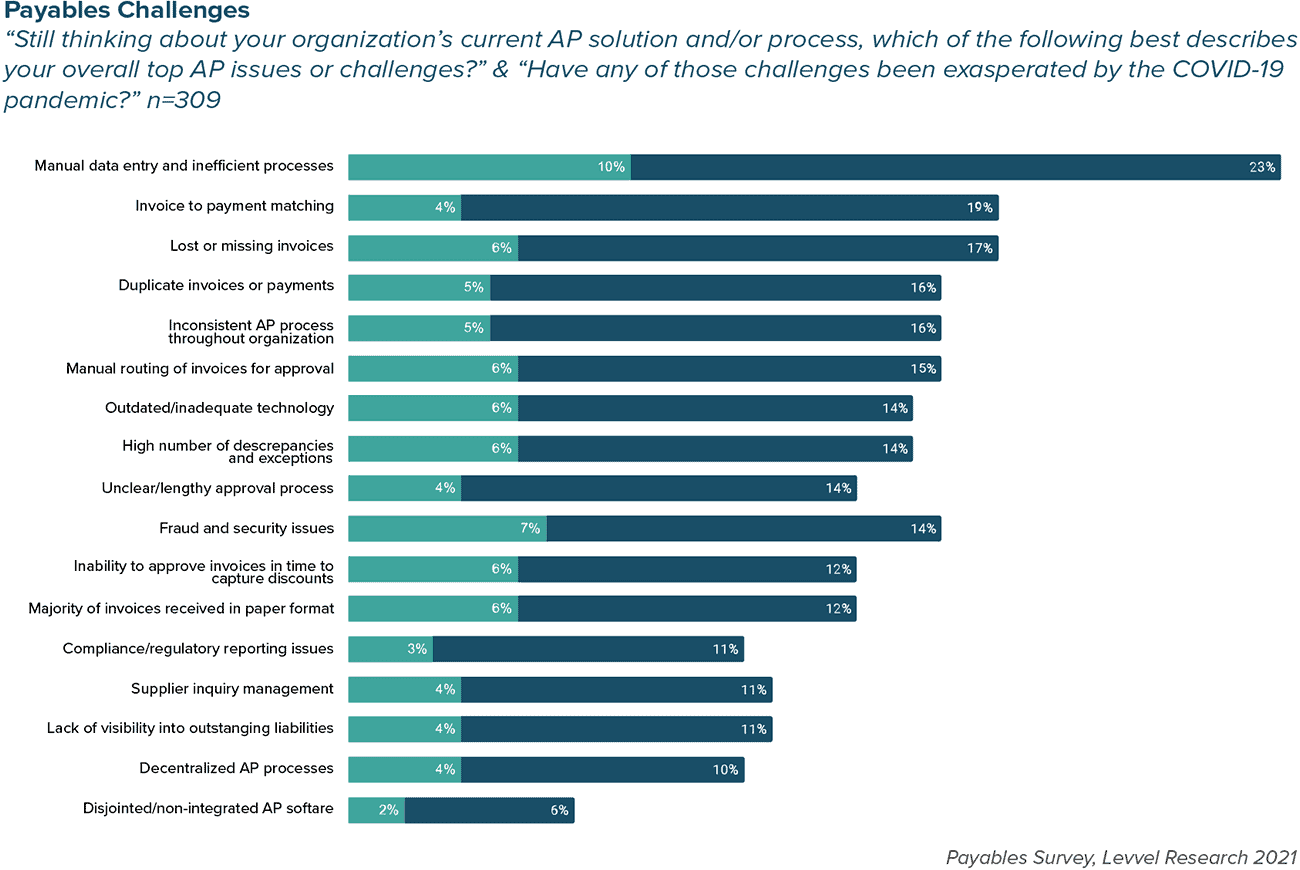

According to industry analysts, many organizations still use time-consuming manual invoice approval workflow processing on over 90% of their invoices. All that mail, faxing, and paper is not just a big bottleneck for AP; it also negatively impacts the company as a whole. According to our Payables Friction Index survey, almost 44% of companies say they still receive invoices by fax. What year is this?

Manual invoicing creates inefficiencies

When invoices are paper-based, arriving documents need to be routed from the receiver/mailroom to the proper department/person, which can add days onto the process and create opportunities for lost/misplaced documents. Multiply those delays by each of the following steps:

-

- Manual invoice approval process starts when an organization receives an invoice from a vendor or supplier

- AP team member manually inputs the invoice data into the company ERP system or accounting program, which requires significant time commitment

- The invoice is then sent to a designated approver for review, and is either approved or queried

- If approved, the invoice is sent for payment

- If queried, the invoice is sent back for further review and processing

- When invoice details are manually verified and approved, it is then sent to accounting for bookkeeping and future audits

The dangers of manual data entry

A paper-based invoice process with manual data entry has a number of drawbacks, chief among those being a slow invoice approval process, human errors, bottlenecks in processing, delayed and/or duplicate payments, and a cumbersome audit trail.

Manual invoice process dangers include:

Invoice processing time: from invoice receipt through matching, approvals, and payment, authorization can take two weeks to almost a month, causing late-payment penalties and lost early-payment discounts.

Invoice error rate: manual inputs and data entry mean errors in accounting, payment delays, duplicate payments, wrong accounts or budgets applied, and the increased time it takes to find and fix the errors.

Cost per invoice: the price for manual invoicing includes the overall cost per invoice, which can be six times higher than that of automated systems. And that doesn’t include the lost savings potential from paying on time.

Negative vendor impacts: suppliers are critical to a company’s competitiveness. Manual invoicing that results in slow and late payments, or payment errors, damages relationships, company reputation, and brand equity.

Forecasting cash flow: efficient invoicing and fast invoice approvals are critical for cash flow management. When slow manual invoicing delays payments and misses discount opportunities, planning cash flow becomes impossible.

Manual invoice approval vs. automated invoice approval (pros and cons)

How to improve the invoice approval process

Improving the invoice approval process means taking a holistic approach to the entire invoice management continuum. Technology is the only way to optimize invoicing processes by gaining accuracy, visibility, speed, and savings at every step according to your specific business rules.

By implementing automated invoice approval as part of a larger AP automation effort, or even a broader procurement digital transformation, you can eliminate the hassles and risks of manual invoice processes that cost companies massive amounts of time, money, and lost business opportunities.

How the automated invoice approval process benefits companies

By leveraging an automated invoice approval process as part of an overall invoice automation or procurement software solution, according to the Ardent Partners Accounts Payable Metrics that Matter in 2020 report, Best-in-Class payable departments are able to achieve:

-

- 6x lower invoice processing cost

- 3x faster invoice processing time

- 57% lower invoice exception rate

What this translates to in the real business world is optimized cash flow, increased time savings, better use of AP team resources, happier vendors, and improved bottom-line impact.

How Corcentric can manage your invoice approval workflow

Companies are eager to remove manual processes from their accounts payable workflow – from purchase orders to payments – and transform AP through automation technology that empowers departments to run with lower processing costs, greater insights, and increased efficiency. We should know, as Corcentric brings a solid track record of customer success with small businesses, mid-market companies, and the Fortune 1000.

Corcentric Cor360 Approval Workflow is a cloud-based invoicing approval software solution that integrates easily with any ERP that your company might be running. Cor360 Approval Workflow accelerates invoice processing by automatically routing every invoice electronically to the correct approver, significantly cutting the often massive delays of manual and paper-based processes. Faster invoice processing lets companies make invoice payments faster so they can seize early payment discounts, generate better payment terms, and lower the cost of doing business.

With 100% visibility into the status of every invoice and where it is in the system, AP teams achieve greater control over spend, working capital, and cash flow.

Download the white paper Why automating the 3-way match matters.

Get started today, contact us.