Preventing payment fraud: Strategies for financial protection

Home - Preventing payment fraud: Strategies for financial protection

Corcentric

As the digital landscape expands, the convenience of online transactions is shadowed by the increasing prevalence of payment fraud, paired with the traditional risk of fraudulent paper checks. With scams ranging from duplicate billing to false vendor invoices and overcharging, businesses face significant risks that can impact their financial integrity. According to research from the Association of Certified Fraud Examiners, the average loss per case of invoice fraud is $125,000. However, the consequences of payment fraud can significantly impact corporations long after the initial breach, including reputational damage beyond the financial loss.

The rise of payment fraud

With payment fraud, businesses are tricked into paying for non-existent goods or services or inflated amounts due. This can occur through various means, from crafting fake invoices to altering legitimate ones. As businesses handle an increasing volume of transactions and expand their supplier networks, the challenge of managing and verifying every invoice grows exponentially, making it difficult to spot discrepancies that could lead to substantial financial losses and a big blow to an organization’s reputation.

Common types of payment fraud

- Fake invoices: Scammers often send invoices for products or services that were never delivered, hoping they will be processed without verification.

- Duplicate or inflated invoices: It’s not uncommon for a vendor or an internal employee to submit invoices more than once, by mistake or intentionally, or to charge more than the agreed price for goods or services.

- Phony vendors: Fraudsters may pose as new vendors or impersonate existing, legitimate ones, altering banking details to redirect payments.

- Check fraud: The deliberate use of fake or altered checks to attempt to obtain funds from an account.

- Phishing email scams: These scams involve emails that mimic those from legitimate vendors or colleagues, asking for updates on payment information, leading to unauthorized payments.

Understanding and preventing invoice fraud

The first step in combating payment fraud and dealing with supplier risk management is understanding its various forms. Awareness of the common types of scams can help businesses identify potential threats and take preemptive action. Implementing rigorous validation processes is crucial.

The Corcentric StopFraud™ validation solution is a comprehensive fraud prevention service that provides automation versus manual processes to mitigate the risks associated with payment fraud by implementing a robust system to protect both customers and their suppliers from potential fraudulent activities.

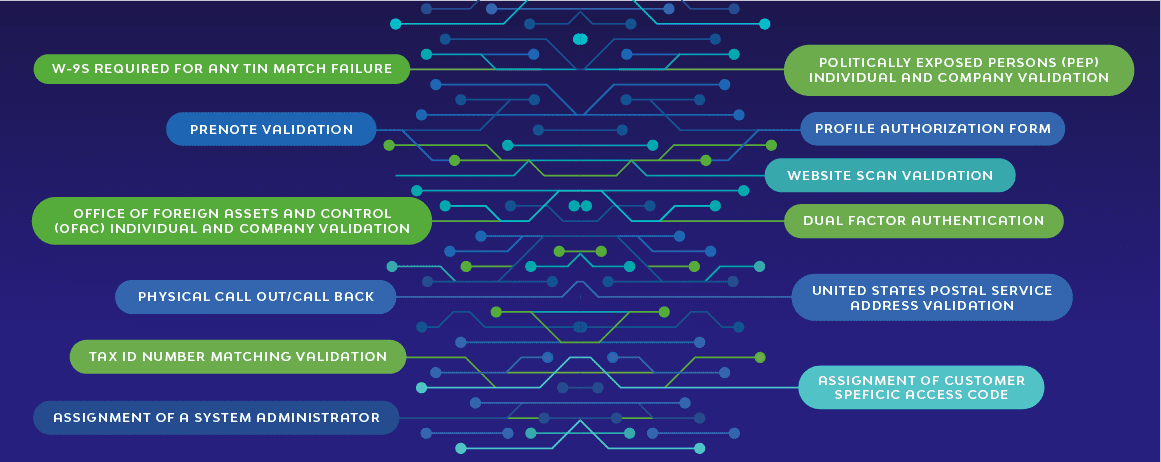

Corcentric’s StopFraud™ system uses 12 distinct security measures to protect important customer and supplier information. This includes giving each customer a unique access code, checking companies against global blacklists, verifying Tax ID numbers with the IRS, confirming supplier addresses through the US Postal Service and requiring W-9 forms for any tax discrepancies.

Additional safeguards from StopFraud™ include website scan validations, the assignment of a system administrator to oversee updates to company profiles, physical call validations for information updates, dual-factor authentication for sensitive changes and a profile authorization form to be completed by a C-level officer to ensure multiple confirmations on critical contact and payment credentials.

Beyond saving your organization money, the documentation and reporting features of StopFraud™ help with internal governance and the increasing level of regulations and compliance requirements demanded by more governments worldwide.

Enhancing internal controls

Beyond employing an automated system, strengthening internal controls is vital for fraud prevention. Here are some steps you should consider:

- Regular audits: Conducting periodic reviews and audits of the accounts payable processes helps identify irregularities and potential vulnerabilities.

- Updated authorization protocols: It’s essential to regularly update and enforce strict authorization protocols for payment processing, ensuring that all transactions are verified and approved by multiple layers of oversight.

- Employee training: Educating employees about the risks and signs of payment fraud empowers them to act as a first line of defense against scams. Regular training sessions can keep the workforce vigilant and prepared.

- Vendor verification systems: Establishing stringent procedures for verifying new vendors and regularly updating vendor information can prevent fraudsters from infiltrating the payment process.

The increasing complexity of the digital economy demands robust strategies to combat payment fraud. By understanding the types of fraud and implementing advanced systems like Corcentric’s StopFraud™ validation solution, alongside continually enhancing internal controls, businesses can protect their financial assets and reputation.

Vigilance and proactive measures are key in navigating the challenges of payment fraud, ensuring that companies can continue to thrive in a digital-first business environment to avoid the financial and reputational risk of payment fraud.