Smart moves: Where AP and ePayables stand right now

- Home

- Smart moves: Where AP and ePayables stand right now

Home - Smart moves: Where AP and ePayables stand right now

Corcentric

According to Ardent Partners’ report, The State of ePayables 2023: Paving the Way for a Smarter Future, accounts payable (AP) teams and ePayables processes are on the cusp of a major transformation — technology-led and AI-powered — that promises to reshape how businesses operate.

In this three-part blog series that explores the Ardent Partners report in detail, chapters one and two of the report — The State of AP and The State of ePayables, respectively — have been combined into one blog, considering that ePayables is essentially an AP automation area. Also, there is overlap in terms of objectives, challenges, and overall direction of the two. In this blog, we will explore the current state of AP and ePayables, shedding light on the latest trends and advancements in this dynamic field.

AP: Higher value, higher expectations

Overall, the current state of AP and ePayables is solid, with recognition by the C-suite of the value that AP brings to the business, both in assisting financial leaders to better understand cash positions and helping manage risk. But success brings visibility, and that naturally leads to higher expectations. That’s why, in today’s rapidly evolving global landscape, AP organizations are seeking innovative ways to optimize their operations to increase workflow efficiency, streamline payment processes, and grow business impact.

Considering that the current state that AP operates in, as Ardent Partners sees it, is one of perpetual uncertainty, the turn toward technology is understandable.

“44% of all business leaders are feeling a “great deal” of uncertainty about what will happen this year, and most express at least “some” level of uncertainty.”

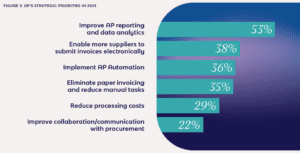

As we’ve often seen in our industry, uncertainty brings opportunity to those who are ready for it. Unfortunately, the report shows that 65% of AP departments are operating without a strategic plan, which makes opportunistic readiness more difficult to achieve. At the same time, AP leaders more universally do have strategic priorities, and high on that list is implementing AP automation solutions.

The smart money is on accounts payable automation

The AP function is experiencing a paradigm shift as organizations recognize the power of automation in streamlining their processes. Manual processes and paper invoices are still holding AP and ePayables back, and are cited by 49% of respondents as a major hurdle on the path to efficiency and strategic impact. Ardent Partners espouses the need to “cultivate a digital mindset…a shared understanding of the potential of digital technologies and their impact on the business.”

Turning to a range of digital solutions that offer increased efficiency, accuracy, and control, companies are embracing advanced technologies such as robotic process automation (RPA), machine learning, and artificial intelligence (AI) to not only automate repetitive tasks, such as invoice processing and data entry, but tap the enormous data intelligence potential inherent in all those financial transactions.

This digital transformation will expand AP’s effectiveness by facilitating more accurate forecasting, while also allowing AP teams to focus on value-added activities, engage in strategic decision-making, and collaborate with LOB stakeholders to drive the organization’s overall success.

The rise of ePayables

ePayables solutions have gained significant traction in recent years, as organizations seek to optimize their B2B payment processes and enhance financial agility. These solutions encompass a range of electronic payment methods, including virtual cards, ACH transfers, and digital wallets.

By leveraging ePayables, businesses can streamline their payment workflows, improve supplier collaboration, and unlock cost-saving opportunities in their payables process. ePayables solutions also offer enhanced visibility into financial transactions, enabling organizations to make data-driven decisions and optimize cash flow management.

The rationale for digital transformation

The integration of AP and ePayables within a digital transformation framework presents numerous benefits for organizations. By digitizing AP processes, businesses gain real-time visibility into their financial operations, enabling better control and decision-making. Automated invoice processing reduces errors, eliminates paper waste, speeds the approval workflow, and accelerates cycle times. ePayables solutions provide faster payment processing, allowing organizations to take advantage of early payment discounts and strengthen supplier relationships. Furthermore, digital transformation enhances compliance by ensuring transparency and auditability in financial transactions.

As was the case with the Ardent Partners 2022 State of ePayables report, AP’s biggest hurdles are almost a one-for-one match with AP’s strategic priorities. It feels like the difference this year is the recognition that technology solutions and a broader digitization strategy are the quickest way to resolve the challenges. While Ardent admits that AI is very hyped at the moment, the way that it enables practitioners to exponentially leverage technology provides a force multiplier previously unimagined.

Leveraging the power of big data capture

The Ardent Partners report notes that the importance of Big Data is at a tipping point. Data has become a strategic asset in today’s business landscape, and AP and ePayables are no exception. As organizations embrace digital solutions, they generate vast amounts of data that can be harnessed to drive insights, improve performance, and achieve competitive advantage.

Advanced analytics and AI technologies enable businesses to unlock the potential of all this data effectively. By analyzing historical patterns, organizations can identify cost-saving opportunities, optimize working capital management, and mitigate risks. Data-driven insights also facilitate strategic decision-making, helping organizations negotiate favorable terms with suppliers and enhance overall financial performance.

Mitigating risks and ensuring security

As AP and ePayables processes become increasingly digitized, organizations must prioritize risk management and security. The rise (and creativity) of digital threats necessitates robust security measures to protect sensitive financial and company information.

Organizations must implement secure payment gateways, encryption protocols, and multi-factor authentication to ensure the integrity of their transactions. Additionally, regular audits and compliance reviews are crucial to maintain regulatory adherence and safeguard against fraud.

None of this is news. What is new are the unknown risks that AI technology brings to the table. Even AI tech executives are pushing for more regulation and scrutiny, which is somehow both reassuring and worrying at the same time. Recognizing the need for security is one thing, but not knowing against what exactly is another.

AP’s path to a smarter future starts here

The landscape of AP and ePayables is undergoing a remarkable transformation as organizations embrace automation, digital solutions, and advanced technologies. The shift towards automation streamlines processes, reduces manual errors, and empowers AP teams to focus on strategic activities. ePayables solutions offer enhanced efficiency, visibility, and cost-saving opportunities, enabling organizations to optimize their payment workflows and strengthen supplier relationships.

Furthermore, the integration of advanced analytics and AI technologies provides organizations with valuable insights to drive performance and make data-driven decisions. Leveraging data effectively can unlock cost savings, optimize working capital management, and mitigate risks. However, organizations must remain vigilant about security and implement robust measures to protect sensitive financial information.

As AP and ePayables continue to evolve, organizations that embrace digital transformation and leverage automation, data analytics, and AI will position themselves for success in the dynamic business landscape. Smart moves today will pave the way for optimized operations, enhanced financial agility, and sustained growth in the future.

Dive into the report, The State of ePayables 2023, on our website.