The advantages of strategic AR credit management

Corcentric

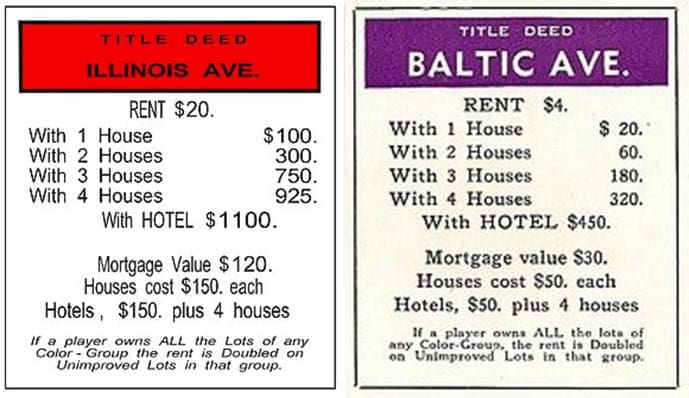

Picture this: You’re playing Monopoly with some folks from your accounts receivable team. You have the choice between these two properties. Which one would you buy, and why?

| ● Lower risk

● Higher potential return ● Better cash flow ● Strategic value

|

● Lower risk

● Higher potential return ● Better cash flow ● Strategic value

|

If you chose Illinois Avenue, congratulations. You’re thinking like a savvy credit manager.

And just as in Monopoly, where you have to continuously assess and balance risk and reward, effective credit management in accounts receivable requires weighing multiple factors to make the best strategic decisions.

The choice between Illinois Avenue and Baltic Avenue mirrors the daily decisions credit professionals face in the order-to-cash process. Selecting the right customers to extend credit involves assessing risk, evaluating potential returns, and considering the overall impact on your company’s financial health. (Spoiler: Always try to get those “red” and “orange” properties.)

In this case, those properties are your customers, and the rent is their timely payments. Since your goal is striving to cultivate a customer base that consistently pays on time and contributes to positive cash flow, the same risk / revenue / value criteria apply to credit decisions in O2C.

Ultimately, honing your credit management strategy can help optimize your accounts receivable process and accelerate cash collection. And we’re not talking Monopoly money.

What follows is an exploration of the eight key aspects of credit management in AR, along with a few real-world insights and best practices.

Risk management and risk assessment in credit management

Before we get going, let’s talk about risk for a moment. It’s tempting to say that AR credit management revolves entirely around risk. It’s just one aspect, albeit a significant one.

In credit management and AR, effective risk management involves systematically identifying, analyzing, and prioritizing risks associated with customer creditworthiness and payment behaviors.

Employing advanced risk assessment techniques—such as predictive analytics and credit scoring models — can give you deeper insights into customer profiles and market conditions. This proactive stance enables you to tailor your credit strategies, ensuring your organization can capitalize on growth opportunities while safeguarding against defaults.

In fact, a comprehensive approach to risk in credit management can do more than protect cash flow; it also enhances strategic decision-making and can give you an edge in navigating uncertainty. Always plenty of that around.

1. Credit policy development

A robust credit policy serves as the foundation for all credit-related decisions within an organization. This comprehensive document should outline:

- Clear criteria for extending credit: Define specific financial thresholds, industry-specific factors, and risk tolerance levels. This ensures consistent decision-making across different customer segments.

- Defined credit limits and terms: Establish tiered credit limits based on customer size, history, and financial strength. Include flexible payment terms that balance customer needs with your cash flow requirements.

- Processes for evaluating customer creditworthiness: Implement a scoring system that considers both quantitative (e.g., financial ratios) and qualitative (e.g., market position, management quality) factors. Regularly update this system to reflect changing market conditions.

- Guidelines for handling exceptions and escalations: Create a clear hierarchy for approval of credit limit increases or policy exceptions. This should include specific criteria for when escalation is necessary and who has authority at each level.

Implementing an automated credit management system can significantly reduce inefficiencies and minimize bad debts. By leveraging technology, businesses can ensure consistent application of credit policies across different customer segments, leading to more informed decision-making and reduced risk exposure.

2. Credit analysis and evaluation

Thorough credit analysis is crucial for understanding the financial health of potential and existing customers. This process typically involves:

- Reviewing financial statements and credit reports: Develop a standardized checklist for financial analysis, including key ratios and trends. Consider industry benchmarks to contextualize a customer’s financial performance.

- Analyzing payment histories and industry trends: Use both internal payment data and external industry reports to identify patterns. This can help predict future payment behavior and adjust credit terms proactively.

- Assessing the overall financial stability of the customer: Look beyond just financials to consider factors like market share, competitive position, and growth prospects. This holistic view can provide insights into long-term creditworthiness.

Advanced analytics tools can streamline this process by automatically gathering and analyzing relevant data. By assessing buyer risk profiles early in the relationship, companies can preemptively address potential payment issues and tailor credit terms to match each customer’s risk level.

3. Invoicing practices

No invoice, no payment. Efficient invoicing is critical for maintaining healthy cash flow, which includes:

- Generating accurate and detailed invoices promptly: Implement a system that automatically pulls data from order management and fulfillment systems to ensure accuracy. Include all relevant details such as PO numbers, delivery dates, and itemized charges to minimize disputes.

- Customizing invoice formats: Tailor invoices to meet specific customer requirements, such as including certain codes or splitting invoices by department. This can significantly speed up the customer’s approval and payment process.

- Implementing automated invoicing systems: Choose a system that integrates with your ERP and can handle complex billing scenarios like recurring invoices, milestone billing, or usage-based pricing.

- Offering multiple payment options: Provide a range of payment methods including ACH, credit card, and newer options like digital wallets. Consider offering early payment discounts to incentivize faster payments.

By optimizing the invoicing process, businesses can significantly reduce Days Sales Outstanding (DSO) and improve overall financial performance. Electronic invoicing, in particular, can speed up the payment cycle and provide better tracking of outstanding invoices.

4. Monitoring receivables

Vigilant monitoring of accounts receivable is essential for maintaining financial health. Key strategies include:

- Regularly reviewing aging reports: Set up automated daily or weekly aging reports with color-coded alerts for different overdue periods. This visual approach can help quickly identify accounts needing attention.

- Implementing automated alerts for past-due invoices: Configure your system to send internal alerts to account managers and external reminders to customers at predefined intervals. Customize the tone and content of these messages based on the customer relationship and amount overdue.

- Conducting periodic credit reviews: Establish a schedule for reviewing credit limits and terms, with more frequent reviews for higher-risk customers. Use these reviews as an opportunity to adjust credit terms based on payment behavior and updated financial information.

- Analyzing payment trends: Use data analytics to identify seasonal patterns or other trends in customer payment behavior. This information can inform cash flow forecasting and guide proactive credit management strategies.

Utilizing AR automation tools can provide real-time visibility into receivables status, enabling proactive management of customer accounts and reducing the risk of bad debts.

5. Collections process

A structured collections process is vital for addressing overdue accounts effectively, without destroying relationships in the process. This balancing act should include:

- A tiered approach to collections: Design a multi-step collections process that escalates in intensity over time. Start with friendly reminders and progress to more formal communications, always maintaining a professional tone.

- Clear procedures for handling disputes: Develop a structured process for logging, investigating, and resolving invoice disputes. Set clear timelines for each stage of the resolution process to prevent disputes from dragging on.

- Integration of automated reminders: Use automation to ensure consistent and timely follow-up on overdue accounts. Personalize these reminders based on the customer’s history and the nature of the overdue amount.

- Training for collections staff: Provide comprehensive training on negotiation skills, conflict resolution, and industry-specific knowledge. Regular role-playing exercises can help staff handle difficult conversations more effectively.

Automating parts of the collections process can significantly improve efficiency while ensuring a consistent and professional approach to managing overdue accounts.

6. Customer communication

There’s no such thing as TMI when it comes to AR. Effective communication is key to building strong customer relationships and encouraging timely payments. Best practices include:

- Providing regular account statements: Send comprehensive monthly statements that include all invoices, payments, and credits. Consider offering real-time access to account information through a secure customer portal.

- Offering multiple channels for customer inquiries: Implement an omnichannel support system that allows customers to reach out via phone, email, chat, or through a self-service portal. Ensure consistent information and service across all channels.

- Ensuring prompt and professional responses: Set and adhere to service level agreements (SLAs) for response times. Train staff to communicate clearly and empathetically, especially when dealing with sensitive financial matters.

- Personalizing communication: Use customer relationship management (CRM) tools to tailor communications based on the customer’s history, preferences, and current account status. This personalized approach can significantly improve customer satisfaction and payment behavior.

By fostering open and transparent communication, businesses can build trust with customers, leading to improved payment behavior and stronger long-term relationships.

7. Embrace technology

Leveraging accounts receivable technology is crucial for optimizing credit management processes. Key AR technological solutions include:

- Automated credit scoring and risk assessment tools: Implement AI-driven credit scoring models that can quickly analyze vast amounts of data from multiple sources. These tools can provide more accurate and dynamic risk assessments than traditional methods.

- Integrated O2C platforms: Choose a comprehensive platform that covers the entire order-to-cash cycle, from order management to cash application. This integration can significantly reduce errors and provide a holistic view of customer accounts.

- AI-powered analytics for predictive insights: Utilize machine learning algorithms to predict payment behavior, identify potential bad debts early, and suggest optimal credit terms for each customer.

- Customer portals for self-service: Implement a user-friendly portal where customers can view their account status, download invoices, make payments, and log disputes. This self-service approach can reduce the workload on your team while improving customer satisfaction.

Implementing these technologies can lead to significant time savings, improved accuracy, and reduced operational costs. Moreover, real-time dashboards and reporting tools provide valuable insights for strategic decision-making.

8. Reporting and analysis

Comprehensive reporting and analysis are essential for continual improvement of credit management practices. This involves:

- Generating regular reports on key performance indicators (KPIs): Create a dashboard that tracks critical metrics like DSO, CEI (Collection Effectiveness Index), and bad debt ratio. Set up automated alerts for significant deviations from targets.

- Conducting trend analysis: Use statistical tools to identify long-term trends in payment behavior, credit utilization, and dispute frequency. This analysis can inform strategic decisions about credit policies and customer segmentation.

- Using data visualization tools: Implement interactive visualization tools that allow users to drill down into data and create custom reports. This can help identify patterns and insights that might be missed in traditional spreadsheet reports.

- Leveraging predictive analytics: Develop models that can forecast future cash flows, predict which customers are likely to default, and suggest optimal credit limits. Regularly refine these models based on actual outcomes to improve accuracy over time.

By maintaining consistent data management practices and utilizing advanced analytics, businesses can gain actionable insights that drive strategic decisions and improve overall financial performance.

Pass Go, collect a lot more than $200

Perhaps the fastest way to win the credit management game is by adopting Corcentric Managed AR. It offers a transformative solution for businesses looking to optimize their credit management and accounts receivable processes.

By leveraging advanced data-driven insights and automation, Corcentric helps organizations reduce Days Sales Outstanding (DSO), minimize credit risk, and liberate working capital trapped in AR ledgers. This comprehensive approach combines credit management expertise, financial services, and cutting-edge software to guarantee business outcomes, allowing finance teams to shift from routine tasks to strategic credit decisions. This solution empowers businesses to improve cash flow, reduce bad debt, and focus on growth opportunities while maintaining strong customer relationships.

Key features of Corcentric Managed AR include:

- Immediate DSO reduction

- Non-recourse agreements to eliminate collections risk

- Predictive analytics for proactive credit management

- Automated invoicing and collections processes

- Real-time visibility into AR performance and credit metrics

Take credit for financial success

Mastering credit management in the order-to-cash / accounts receivable game takes more than a role of the dice. It requires foresight, careful planning, and the ability to balance risk and reward. By focusing on these eight key aspects – and leveraging technology effectively – you can build an unbeatable credit practice and approach that helps reinforce financial stability and provides flexibility for business growth.

If you’re ready to see how Corcentric can put your company a few moves ahead, download our free guide and then give us a call.