Originally appeared in PYMNTS.com

Those who hesitate often end up playing catch-up, and that goes double for businesses during the historic digital shift that’s remaking back-office finance departments with superior systems.

Accelerating the upgrade of finance stacks is paying off, particularly for mid-market firms always looking for an edge over enterprise competitors. They’re finding it with digital platforms and application programming interfaces (APIs) that vastly improve visibility.

For the study Business Payments Digitization: The Fast Track To Payments Systems Upgrades, a PYMNTS and Corcentric collaboration, we surveyed 400 chief financial officers (CFOs) from U.S. mid-market firms doing $400 million to $2 billion in annual revenues in five industries, manufacturing, finance, retail, transportation and healthcare. Here’s a survey snapshot.

- 74% of Firms Say Digital Payments Improves Working Capital Management

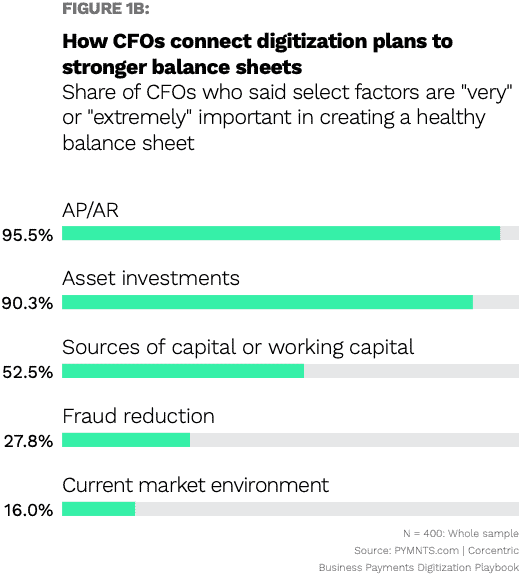

A major area of improvement seen among mid-market players from digitizing AP and AR functions comes down to better managing working capital.

Per the study, “45% of CFOs who accelerated payment process digitization say they did so to improve management of cash flows or working capital, but 84% of CFOs could point to improved management of working capital when the projects were completed.”

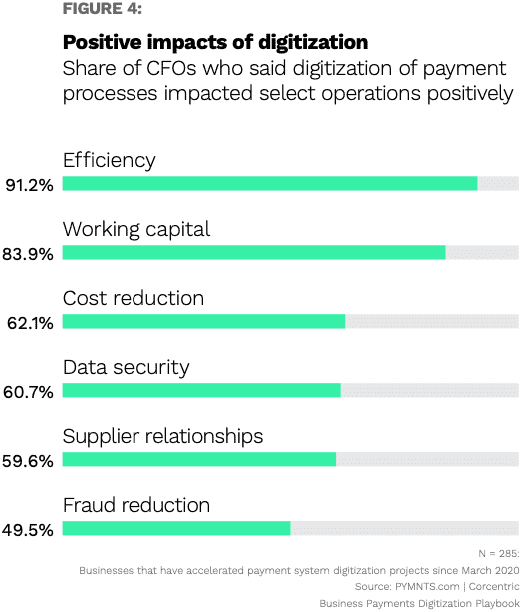

- 91% of CFOs reported efficiency gains from digitizing payments systems

While 61% of CFOs we surveyed upgraded with efficiency gains in mind, others that had different drivers for digitizing also achieved the efficiency gains in the process.

“These improvements were among the chief gains companies sought as they worked on their digitization projects and highlighted the benefits available to other companies that adopt and manage innovative technology such as digitized payments systems,” the study states.

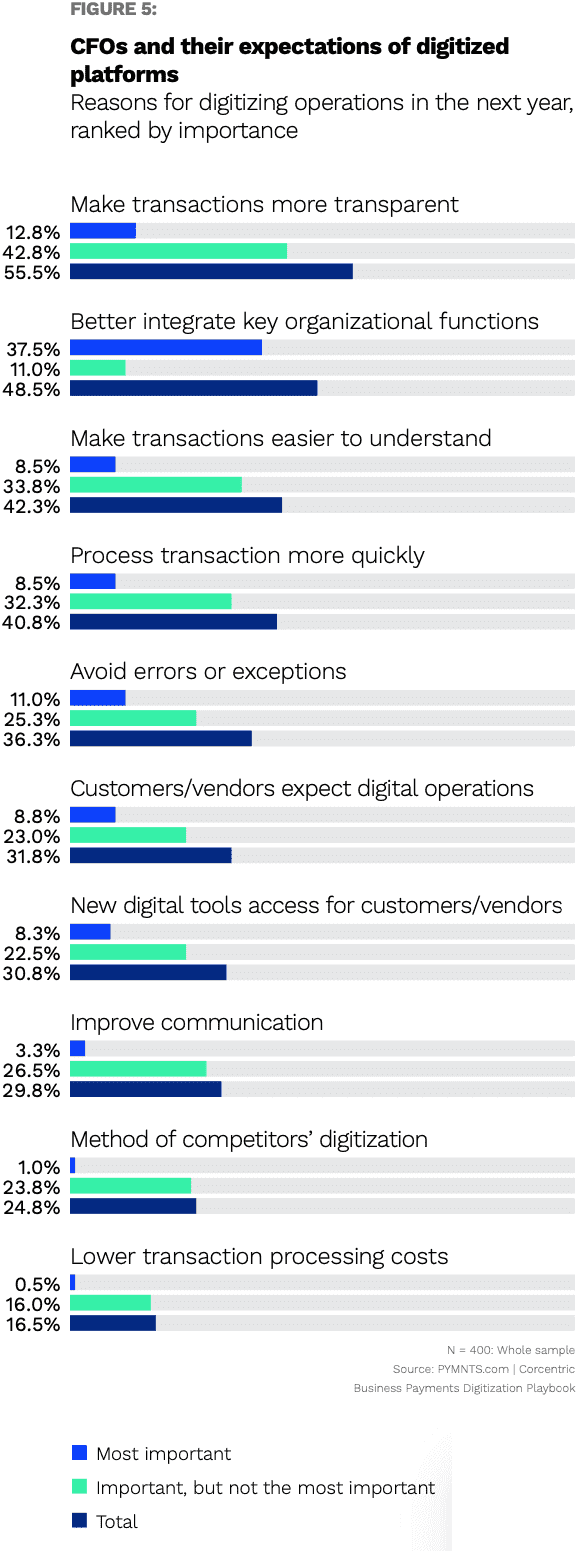

- 56% of CFOs want digitization to help make transactions more transparent

Revealed in the findings is the fact that CFOs are working hard to reduce system drag and inefficiency in their payments stacks, and they have high expectations for these investments.

While 56% of CFOs surveyed reported that digitization can help with transactions transparency, 13% said transparency “is the most important outcome, and 42% say they want transactions that are more understandable,” and with 9% calling this their prime reason to digitize.

Get the study: Business Payments Digitization: The Fast Track To Payments Systems Upgrades

To learn more about how companies from a wide range of industries are using payments digitization to transform their operations, download the report.