Get paid faster… on your terms

Corcentric Supply Chain Finance solutions guarantee payment and DSO reduction to suppliers on your terms. As your supply chain finance provider, our supplier risk mitigation solution enables suppliers to improve cash flow while you gain greater control over your working capital.

Get paid faster… on your terms

Corcentric Supply Chain Finance solutions guarantee payment and DSO reduction to suppliers on your terms. As your supply chain finance provider, our supplier risk mitigation solution enables suppliers to improve cash flow while you gain greater control over your working capital.

Get paid earlier than due date

Guaranteed, fixed DSO for your receivables through our sustainable supply chain finance solution. Accelerate your invoices 15, 30, 40, or even 60 days earlier while your buyers pay as usual.

Receive payments on time, every time

No more unpaid invoices. Corcentric’s supply chain risk management solutions eradicate your credit risks and eliminates bad debt expenses.

Cost savings

Eliminate the burden of billing production and distribution, credit issuance, collections, and disputes.

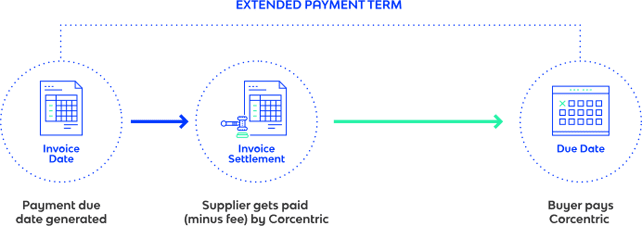

How Supply Chain Finance works with Corcentric

Suppliers get paid early

- The suppliers establish the relationship with Corcentric

- Corcentric pays the suppliers earlier than contracted terms with the buyer. The acceleration period can be 15, 30, 40 or even 60 days earlier

- The buyer gets billed by Corcentric on the terms established with the buyer

- Suppliers pay Corcentric a finance fee

Supplier benefits

Guaranteed payment and DSO reduction

Corcentric provides guaranteed payment and DSO reduction to suppliers. Payments to the suppliers are on-time, every time, and faster than buyer’s dictated terms.

Turnover of credit and collections

No more chasing down payments; 100% of buyer payments are handled by Corcentric. Your receivables risk is eliminated and transferred to Corcentric. Corcentric issues and monitors credit and collects the payments due.

Lower administrative costs

Too much time is spent on verifying a customer’s worthiness and chasing payment. With the risk management being assumed by Corcentric, a supplier’s employees can now focus on higher value tasks that lead to building a better business.

Improved customer relationships

Friction over payment terms and invoice disputes are two major points of contention that can harm a B2B relationship. With Corcentric acting as the middleman, payment term friction is eliminated. Better relationships often lead to more business and stronger, longer lasting partnerships.

Access to innovative portal

Incoming and outgoing payments are recorded in full, with a complete audit trail. That means both suppliers and buyers can stay up to date on transaction status and cash flow. Visibility and knowledge allow each party to optimize their working capital.

“An estimated 23% of organizations in a Gartner 2020 poll relied on supply chain finance to increase available cash flow to the business in the face of pandemic-driven economic headwind”