Managed Accounts Receivable Solutions

Transform your AR management with a solution that pays for itself

Home - Managed Services - Managed Accounts Receivable Solutions

Go beyond software—let Corcentric’s AR Management Services experts help optimize your cash flow and strengthen customer relationships.

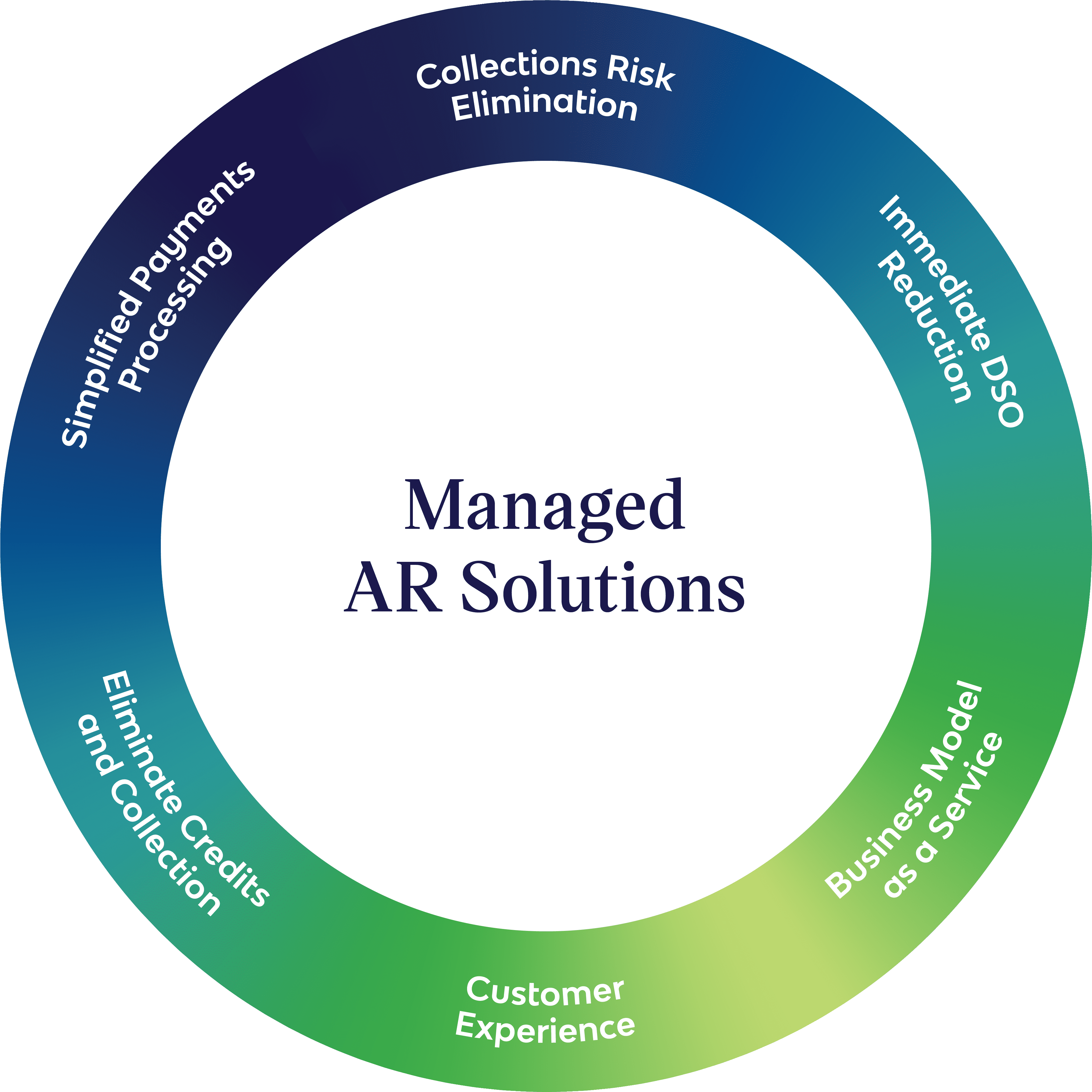

Streamline your Accounts Receivable (AR) with Corcentric’s Managed AR solution. From invoice creation to collections, we combine advanced technology and expert support to accelerate cash flow, reduce DSO, and eliminate bad debt risk—all without upfront costs. Gain predictable cash flow, operational efficiency, and scalable growth while freeing your team to focus on strategic priorities.

Analysis

Accounts Receivable Management Solutions Can Pay for Themselves

Guide

The Ultimate Guide to Accounts Receivable Management

Control your payments lifecycle, lower your DSO today

By leveraging our team of accounts receivable experts, businesses can achieve cost savings, operational efficiency, and improved financial control. Let Corcentric be your strategic partner in achieving AR excellence.

Reduce and optimize DSO

You determine when you receive payments. Just tell us when you want to be paid and Corcentric will pay you in full.

Eliminate bad debt and collections risk

When your invoices are paid on time, that means no bad debt or credit risk for you. Plus, a non-recourse agreement ensures you’re not liable for late payments.

Liberate working capital

Unlock cash on your balance sheet that can be used to fund growth and/or improve the liquidity of your organization.

Our experts manage your AR processes

Andrea Cassidy

Senior Financial Operations Lead, Corcentric

John Grone

VP, Financial Operations, Corcentric

Steve Fallows

Director, Managed AR Growth & Development • GCS - Customer Success

To move at the speed of business, software isn’t nearly enough

Corcentric guarantees business results for you, from day one, with our team of Managed Accounts Receivable experts. By partnering with us and leveraging our managed accounts receivable solutions to transform your AR processes, you unlock immediate advantages such as reduced DSO, improved on-time payments, and enhanced working capital flexibility.

Cash Application

Get paid on your terms with a single, consolidated payment while Corcentric’s AR Management Services handle all aspects of cash application, including invoice matching, remittance, and reconciliation.

- Faster payments on your terms: Choose when you get paid — 5, 15, or 30 days earlier — while buyers stick to their payment schedules

- Simplified cash application: Corcentric handles remittance, invoice matching, and reconciliation to streamline your payment process

- Reduced team workload: Lift the burden of manual cash application, deduction management, and reconciliation from your finance team

Invoicing

Corcentric AR management automates invoicing, connects customers through a branded portal, and handles validation, presentment, and distribution to improve accuracy and cash flow.

- Automated invoicing processes: Improve accuracy and efficiency by automating validation, presentment, and distribution

- Branded self-service portal: Enhance customer experience with a portal for invoice review, approval, and dispute management

- Improved cash flow: Reduce costs and DSO, leading to better cash flow and faster payments

Collections

Corcentric AR management handles collections, freeing up your investment in human capital, technology, and compliance, reducing resource needs while preserving customer relationships.

- Lower resource investment: Eliminate the need for significant internal resources, technology, and compliance expertise for collections

- Proactive communication: Our proven approach ensures delinquent accounts are managed effectively while preserving customer relationships

- Trusted expertise: Leverage 20+ years of experience in collections to recover payments without jeopardizing future business

Dispute Management

Corcentric’s O2C solutions prevent disputes before they escalate and resolve them seamlessly with minimal involvement from your team.

- Dispute prevention: Our expert dispute and exception management team uses your business rules and root case analysis to prevent and mitigate any disputes, with proven online dispute and exception management technology

- Self-Service dispute management: Online dispute management portal simplifies management of disputed invoices

- Dispute resolution: Corcentric provides one point of contact to manage all disputes and resolutions

Financing

Corcentric’s receivables financing provides guaranteed on-time payments, giving you greater control over working capital.

- Invoices paid earlier than due date: Guaranteed, fixed DSO on receivables — 15, 30, 40, or even 60 days earlier — while your buyers pay as usual

- Payment receipt on time, every time: Corcentric eliminates credit risks and bad debt expenses with no more unpaid invoices

- Serious cost savings: Remove the burden of billing production and fulfillment, credit issuance, collections, disputes, and exceptions resolution

Customer Stories

"With Corcentric, it's been a partnership every step of the way."

Robert Mcilvaine, Chief Technology Officer, Aurora Parts

Aurora Parts talks Managed Accounts Receivable with Corcentric

Aurora Parts, a leading provider of aftermarket service solutions for heavy-duty trailering equipment in North America, turned to Corcentric’s Managed AR solution to better strengthen relationships with suppliers.

"We wouldn't be able to grow without Corcentric managing all the complexities of the billing process"

Nick Chapman, Manager of DTNA Parts, Fleet Boost

Daimler extends customer service into accounting with AR management

Daimler Trucks North America (DTNA) partnered with Corcentric to overcome the complexities of managing its extensive dealer network, reducing billing disputes to less than 0.4% and driving parts sales from $500 million to over $1.7 billion annually.

Our customers have achieved

60%

Days sales outstanding (DSO) reduction

86%

Decrease in disputes

0

Bad debt

Go Deeper

Efficient management of the order-to-cash (O2C) process is vital for maintaining healthy cash flow and operational success. Learn steps you can take to improve the O2C process . Your customers’ payment experience is a key part of the overall AR process. Check out this post for a number of practical tips for streamlining AR operations, and this one on the importance of the human touch to understand how collaboration between AR teams and other departments, such as sales and customer service, facilitates a comprehensive approach to client management, leading to more effective payment plans and dispute resolutions.

Effective working capital management is crucial for maintaining a company’s financial health, as it ensures sufficient liquidity to meet short-term obligations and invest in growth opportunities. Implementing strategies such as optimizing inventory levels, negotiating favorable payment terms with suppliers, and accelerating accounts receivable collections can significantly enhance cash flow. Additionally, leveraging technology for real-time financial monitoring enables more informed decision-making and proactive management of working capital. By focusing on these areas, businesses can improve operational efficiency and strengthen their financial position.

Electronic invoicing (e-invoicing) is the digital exchange of invoice documents between suppliers and buyers, streamlining transactions and enhancing efficiency. Unlike e-billing, which often involves sending invoices via email or web portals, e-invoicing utilizes structured data formats like EDI or XML, enabling seamless integration into financial systems and automated processing. In Europe, the adoption of mandatory B2B e-invoicing has accelerated, driven by the need to enhance VAT collection and reduce tax fraud. Countries such as Italy, France, and Spain have implemented or are planning to implement mandatory e-invoicing requirements for B2B transactions.

Invoice factoring, the practice of selling accounts receivable to a third party at a discount to improve cash flow, presents several risks that businesses should carefully consider. One significant risk is the potential loss of control over customer interactions, as the factoring company assumes responsibility for collections, which can strain client relationships if not managed delicately. Additionally, many factoring agreements are on a recourse basis, meaning the business remains liable if customers fail to pay, thereby not fully mitigating credit risk. To address these challenges, alternatives like Managed Accounts Receivable (Managed AR) services offer a more integrated approach, acting as an extension of the business to maintain customer relationships while providing non-recourse financing to protect against bad debt.

Effective invoice billing and management are essential for maintaining healthy cash flow and fostering strong client relationships. Implementing best practices, such as understanding the various types of invoices —standard invoices, pro forma invoices, and credit memos—ensures clarity and appropriateness for each transaction. Crafting comprehensive invoices that include detailed business and client information, unique invoice numbers, precise dates, itemized service descriptions, clear payment terms, and the total amount due minimizes misunderstandings and disputes.

Improving your accounts receivable (AR) turnover ratio is essential for maintaining healthy cash flow and operational efficiency. This ratio measures how effectively your company collects payments, indicating how often receivables are converted into cash over a specific period. A higher AR turnover ratio suggests prompt collections, while a lower ratio may point to inefficiencies in the collections process. To enhance this ratio, consider implementing strategies such as strengthening client relationships, conducting thorough credit assessments before extending credit, automating invoicing systems, setting clear payment terms, offering multiple payment options, and providing incentives for early payments.

Partnering with Managed Accounts Receivable (AR) professionals offers businesses a strategic advantage by streamlining cash flow and enhancing financial stability. These experts bring specialized knowledge and advanced technologies to efficiently handle invoicing, payment collections, and credit assessments, allowing companies to focus on core operations. By outsourcing AR management, businesses can reduce administrative burdens, minimize bad debt risks, and improve customer relationships through timely and accurate billing processes. Hear from our experts Amanda and Steve Fallows.

Ready to take the next step?